Manufacturers devote considerable time and resources to managing their physical supply chain, but often it's their financial supply chain that needs the most attention. As costs continue to escalate, managing cash and capital is just as important as managing relationships among supply chain partners. And in many cases, the integration between the physical and the financial supply chain is such that any weak links in one of the chains will threaten the vitality of both chains.

By way of definition, "the financial supply chain refers to the transactions that occur between trading partners that facilitate the purchase of, and payment for, goods and services, such as sending purchase orders and invoices, and making payment," explains Scott Pezza, senior research associate with analyst firm Aberdeen Group.

See Also: Lean Supply Chain Logistics Best Practices

Just as finance involves much more than just "bean counting," the financial supply chain represents the actual lifeblood of an organization, as it provides the cash flow needed to ensure the doors are kept open, the lights are kept on, the employees are being paid and products are being made and shipped.

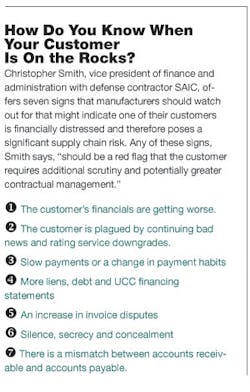

According to a study of corporate executive and senior financial managers conducted by Aberdeen, the top two pressures motivating manufacturers to focus on the financial supply chain are demand volatility's impact on available cash, and the risk of trading partner default. When there is volatility in demand, manufacturers are pressured both internally (adding more inventory buffer to avoid out-of-stocks) and externally, with the inflow of cash slowing and becoming less predictable, Pezza notes. "The risk of trading partner default will impact the value of accounts receivable," he adds, "with an increase in the allowance for doubtful accounts."

Keep Everybody on the Same Page

When it comes to managing cash flow at Toyota Industrial Equipment Manufacturing Inc. (TIEM), a Columbus, Ind.-based manufacturer of lift trucks, it all begins with the budget process, which allocates the appropriate funds to ensure the company can fund its production operations (e.g., labor, raw materials, product development). Then, once the budget is developed, "all key personnel are expected to meet these targets to ensure our actual financial performance," explains Joe Kurdziel, accounting manager at TIEM (a 2011 IW Best Plants winner). "In the event we cannot meet our budget, we would review our capital expenditure plan to postpone cash disbursements to ensure that the manufacturing process continues at an optimal level."

According to Kurdziel, it's important for the finance department to work closely with the supply chain departments in various aspects of the business. "Finance provides the reports to assist these departments in their day-to-day decision-making processes as well as budgeting and capital expenditure planning," he explains. The key decision-makers are the department vice presidents as they, along with the president, drive TIEM's short- and long-term targets and goals for their respective areas of responsibility.

"Communication is very important in Toyota's environment," he notes, "and the executives meet daily to discuss the events of the day. This meeting also includes the managers that report to these executives. This ensures that all the necessary associates are available to identify and clarify any issues." As you would expect, TIEM also utilizes many of the lean methodologies championed by parent Toyota Motor Corp. (IW 1000/8) to promote improvement in all areas.

Commodity Risk Management

As companies become more global, sourcing the materials for their products from anywhere in the world, they also become exposed to a higher likelihood of commodity risk. "Commodity prices have become very volatile," says Ada Cheng, vice president and assistant treasurer with food & beverage giant PepsiCo Inc. (IW 500/18), "to the point where even market experts can't predict future prices." Commodity risk management (CRM) has become very important to PepsiCo because of a need to reduce uncertainty, while increasing productivity.

"It's important to understand the manufacturing side of the business in order to hedge on commodity prices," Cheng says. To that end, PepsiCo's treasury department works hand in hand with manufacturing to ensure everybody is on the same page. "Any change in the production cycle or any specific issues overseas could have a serious impact on our hedging strategy," she notes, so communicating all relevant information across the various departments is a crucial component to effective management throughout the financial supply chain.

Traditional Roles Will Have to Change

Carlos Alvarenga, global lead for operations finance and risk for consulting firm Accenture, has proposed a financial supply chain management framework for companies to consider, which begins with the creation of an integrated team that combines both finance and supply chain management expertise. Such a team should first study advanced operations research, real option, risk management, and financial optimization tools and techniques. The goal is a transformation "from a function focused only on real product flows and facilities to one that is concerned with corporate-level risk, financial performance and shareholder risk and returns."

As an example, he cites aerospace manufacturer Boeing Co. (IW 500/16), which employs numerous financial techniques when making product development and strategic sourcing decisions, such as: investment and risk modeling, demand (price and quantity) modeling, spreadsheet modeling and portfolio analysis. While Boeing is celebrated for its ability to design and engineer aircraft, less well known is how the company includes financial design considerations into its decisions as well. For example: Can unit costs be lower if the company spends more on automating production? Are new design features a good investment, or would Boeing actually sell more planes if they kept the price lower? Thinking about design and production from the perspective of risk and probability has helped Boeing make more strategic decisions, Alvarenga asserts.

He admits that for manufacturers to evolve to a point where finance and supply chain converge, "traditional roles will have to change, as will power over supply chain management decisions." As he sees it, the CFO will evolve into a chief supply chain officer as well, which raises a number of implications for those currently in supply chain roles. He suggests that supply chain strategists will "need to rethink their training and expand their view and knowledge of finance and risk management in the coming years."

For more on Supply Chain Finance, see "Quicker Access to Cash...at a Price."

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.