When it comes to enterprise software like enterprise resource planning (ERP) and enterprise asset management (EAM), not every company is created equal.

A manufacturer with predictable, repetitive processes may find a broad spectrum of software offerings that can meet their needs. But some companies, like engineer-to-order manufacturers, engineering procurement and construction contractors and even process manufacturers find their situation so demanding than even tier I ERP products cannot meet them completely.

One area that frequently is left wanting for this latter group is project management. Because ERP came from the world of materials planning for repetitive manufacturing and EAM often amounts to a glorified maintenance work order management system, these applications cannot address the more anecdotal, complex and dynamic requirements of real-time enterprise project management.

At least that has been our experience as we interact with executives at project-centric and asset-intensive companies. And that is also the conclusion of a recent study IFS North America conducted with help from Mint Jutras Principal Analyst Cindy Jutras.

Study Results

We surveyed more than 200 executives with industrial companies with more than $100 million in annual revenue. We then ran frequencies on the data to identify the companies with more complex, project-centric business models. These companies proved to be:

- Companies engaged in engineer-to-order manufacturing.

- Companies delivering projects as an engineering, procurement, and construction contractor.

- Those involved in batch process, which would cause them to be involved heavily in enterprise asset management of process manufacturing plants and equipment.

Reviewing the data, it becomes clear that exposure to projects enters an organization in two different ways: Either the company relies on projects as part of its product delivery system or it relies on projects as a way to manage its capital assets.

Engineer-to-order manufacturers and engineering procurement construction contractors are examples of the former. They are involved in short run or one-off projects where the administrative and management overhead costs normally counted as overhead must be accounted for and managed just as aggressively as materials and manufacturing or fabrication costs.

Process manufacturers are an example of the latter. They plan, construct and then maintain process manufacturing plants and equipment to yield a return over a period of years or decades. That entire asset lifecycle may be considered a project that needs to be managed on a macro level. But on a micro level, there are numerous equipment installations, refits, overhauls and plant shutdowns that require aggressive project management to control cost, ensure a successful outcome and limit business disruption.

Many other manufacturers, according to the study, find their product lifecycles are short enough that they, too, are best managed as a project. The conception, engineering, design, prototyping and product launch cycle may come frequently enough that they represent a significant portion of the cost of a given product or product line. Again, project management is required on both the macro and micro levels.

Tighter Integration

Without exception, important project elements are better controlled when there is tight integration between systems used to manage projects and the rest of the enterprise. It is not hard to imagine why this is the case.

If a company is using a standalone piece of project management software, that system may really only be a way to display project data visually across a Gantt chart. Or, it may be a system to more proactively track project deliverables. But if it is removed from the enterprise system that actually drives the completion of that work and the reporting of project results across functions like purchasing, maintenance, engineering and manufacturing or fabrication, real-time visibility and control is hampered.

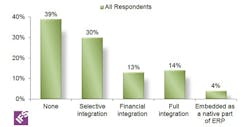

The fact that 39% had no integration between their project management and their ERP and only 4% use a module of their ERP as part of their project management solution would suggest a great deal of room for improvement.

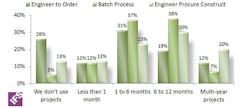

The length of projects a company is involved in naturally contributes to the problems they may experience trying to run separate project management and enterprise software. The longer the duration of the project, the more complex and the greater need for integration with things like advance ordering of long lead time items, subcontractor billing and subcontract management, progress billing and cash flow management. In some cases, projects run by study participants are fairly well contained at less than a month long. Most engineer-to-order environment respondents are involved in projects of between one and six months.

Use of Microsoft Project is prevalent among study respondents. There is an enterprise level version, but the vast majority of Microsoft Project use is in a desktop configuration. Microsoft Excel, the universal spreadsheet management tool, is also heavily used. The key to using Excel without creating silos or islands of data is to integrate it with your enterprise applications so you can share the enterprise data through Excel while it still in fact resides in ERP. Once an Excel spreadsheet exists wholly outside of the enterprise software environment, managers are at risk of making decision based on bad data, or your enterprise application may cease to be the true system of record.

Risk, Cash Poorly Managed

Projects involve risk – more risk than repetitive processes that are more predictable and easily controlled. And while risk management may be intuitively associated with assuring on time and under budget project performance, it also in many companies and industries has implications for performance against contractual commitments as well as protection of the environment and mitigation of safety risks.

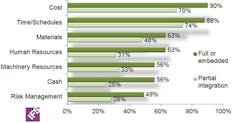

While 78% of respondents can control schedules in real time and 76% can control costs, a much smaller percentage can manage risk in real time.

Respondents reporting full integration or embedded project control within their ERP system, the ability to control the cost and schedules increases into the high 80th or even the 90th percentile. With this tighter integration, the ability to manage the materials, the human resources, machinery, cash and risk also increases from the 30% range to about 50%. But risk management is the least supported project need, even with the levels of integration between projects and ERP reported in the study.

It is also not surprising that cash is poorly handled by existing project ERP configurations. To manage cost in a project environment requires very thorough integration indeed. Contract management, purchasing and other functionality plays a role in determining committed cost … the degree to which firm obligations or purchases have been made with regard to project expenditures. Very few applications can track committed cost.

Charles Rathmann is an analyst with IFS North America. He has been involved in writing about and consulting with complex industrial businesses for more than 20 years. Rathmann holds a B.S. degree in Journalism from the University of Wisconsin at Oshkosh.