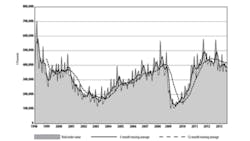

U.S. machine shops and other manufacturers ordered new equipment and related technologies worth $371.97 million during August, an increase of nearly 5% over the July total, yet falling well short of the year-ago result. In August 2012, new orders totaled $454.19 million, meaning the latest month is 18.1% off the pace.

The data is contained in the U.S. Manufacturing Technology Orders report, a monthly study by AMT – the Association for Manufacturing Technology. The information is based on actual data reported by participating companies. The information includes figures for metal cutting products as well as metal forming and fabricating products, and the figures are tabulated for six geographic regions as well as the nationwide U.S. totals.

The 2013 year-to-date results offer more perspective on the slower demand in manufacturing technology. For the January-August 2013 period, U.S. buyers have ordered $3.1 billion of new equipment and related technologies, which is 18.1% less than the eight-month totals for 2012. That pace will be hard to reverse, as the September 2012 total represented a recent high for new machine tool orders.

The increase for August versus July shows greater demand for metal cutting equipment (5.0%) than for metal forming/fabricating equipment (1.9%), though the year-to-date results also indicate a greater disparity for metal cutting equipment (-18.4%) than for metal forming equipment (-7.1%).

Even so, the USMTO’s authors noted some positive readings of the information:“We’re finding many reasons for optimism within the manufacturing economy,” stated AMT president Douglas K. Woods. “In addition to the monthly gain for USMTO, the latest Purchasing Managers Index was at 56.2, its highest reading in more than two years.

“Because of manufacturing’s international connectivity, we also welcome the improvements seen in the global markets in Europe and Asia,” Woods continued. “These gains are expected to continue for U.S. manufacturing as we head toward 2014, but all of this hinges on avoiding a government-induced economic derailment.”

August Regional Results

The August USMTO report does not include some results for metal forming/fabricating equipment, as AMT noted adjustments are being made to make the survey participants more comparable from year to year.

In the Northeast, total new orders for manufacturing technology fell 18.2% during August to $61.46 million from July’s result, $75.10 million. The region’s year-to-date total for new equipment is $522.43 million, up 6.3% compared the January-August 2012 period.

Data for the Southeast region is incomplete, missing a reading for metal forming equipment. Metal cutting machinery sales during August amounted to $34.24 million, an increase of 1.3% versus July and a decrease of 26.7% versus August 2012.

The Southeast region’s eight-month order volume is $271.75 million, down 20.2% versus the region’s January-August 2012 total.

The North Central-East Region posted $95.67 million worth of new orders for manufacturing technology during August, up 16.9% over the July total but down 10.8% compared with the August 2012 figure. The region’s eight-month total for 2013 -- $800.29 million -- is 7.4% less than the comparable 2012 figure.

In the North Central-West region, new orders rose 20.2% from July to August, to $70.33 million, but that total is 22.4% less than the August 2012 figure. For the year-to-date, the North Central-West has returned $575.06 million in new orders, 6.9% less than the January-August 2012 total.

The South Central region had new orders for machine tools and related technology of $50.05 million during August, down 15.3% the July figure, and down 22.1% for January-August 2013 against the comparable result for 2012.

Finally, though West region totals are incomplete for August, new orders for metal cutting equipment rose 30.5% from the previous month, down 30.6% from August 2012, and up just 1.8% for the year-to-date comparison.