NAM/IndustryWeek Q4 Survey: Sharp Decline in Manufacturers' Optimism

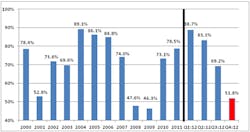

Manufacturing activity has stalled of late, global sales are slowing and the threat of going over the fiscal cliff looms. These are contributing factors to a sharp decline in manufacturers’ optimism, which has plummeted from 88.7% in March to barely more than 50% today.

Add in the U.S. economy’s modest growth this year—most likely up 2% in the current quarter and for the year—and it’s easy to understand why business leaders are increasingly more worried about their business’s prospects.

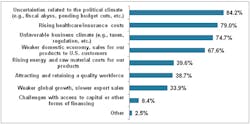

The most recent NAM/IndustryWeek Survey of Manufacturers finds that 84.2% of respondents said that political uncertainties—including the fiscal cliff and budget sequestration—were their top challenge. These anxieties are dampening hiring and investment and reducing overall optimism

.

A look back at earlier survey results illustrates steadily declining sentiment. This troubling trend does not bode well for manufacturers in the United States or the 12 million people they employ. In March, 88.7% of manufacturers were either somewhat or very positive about their company’s outlook. This optimism fell to 83.1% in June and 69.2% in September. In the fourth quarter, the outlook fell even further to 51.8%, its lowest point since the second quarter of 2009. The number of manufacturers who responded as “somewhat negative” in their outlook nearly tripled in the past six months, from 15.8% in June’s survey to 38.9% in the fourth quarter.

This decline potentially foretells of further weaknesses in the economy moving into 2013. Using regression analysis, we are able to predict industrial production two quarters from now. In the last survey which was released in September, the business outlook value corresponded to a 1% drop in industrial production for the manufacturing sector.

Manufacturing production was 1.7% lower in October than it was in July, or 0.9% from September. While Hurricane Sandy contributed to some of the recent decrease, the data suggest larger weaknesses since the summer. The current outlook predicts a drop in industrial production of 2%t between now and the second quarter of 2013) , with essentially no year-over-year growth.

This might be consistent with a fiscal cliff scenario, or it is simply the statistical result of the overly pessimistic responses. However, this model has a fairly solid track record, explaining roughly 90% of the variation since 1997.

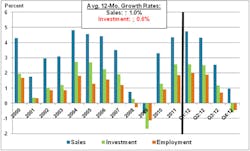

With reduced sales expectations, manufacturers appear to be pulling back on their hiring and capital spending plans. Both measures turned negative in this survey for the first time since the fourth quarter of 2009.

Note: Industrial production is predicted two quarters in advance by regressing NAM/IndustryWeek Survey of Manufacturers data as one of the independent variables, with data stretching back to Q4:1997. Other explanatory variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500.

Investment and employment should decrease on average by 0.6% and 0.4%, respectively, over the next year. This represents a shift from the past survey, which anticipated gains of 1.2% and 0.7%, respectively. These results indicate that more than one-third of manufacturers expect decreases in capital spending plans in 2013, with almost 27% seeing reduced employment. Of course, this is not true for all firms, as 15.6% plan capital spending increases of 5% or more, and 17.7% intend hiring increases of up to 5%.This increased negative outlook can also be seen in manufacturers’ responses on expected sales, employment and capital spending for the next 12 months. We began the year with businesses anticipating 4.7% more sales on average on a year-over-year basis. That significantly declined to 2.5% in September, and it has now plummeted to just 1%.

More than 27% of manufacturers now expect their sales to fall in the next year, up from 16.6% in September. On the positive side, 26.6% predict sales increases of 5% or more. This indicates that there are businesses that are prospering despite the headwinds they are facing, but it also shows just how mixed the overall results are.

Manufacturing Wages

Manufacturing wages are expected to rise by 1.1% over the next 12 months, a decline from the 1.5% stated in the last survey. Almost 53% of respondents planned to provide raises of up to 3%, with another 35% saying that wages and salaries for their companies will stay about the same. This does not include the additional costs of benefits, which have been significant, particularly for health insurance. Seventy-nine percent of manufacturers cited rising health insurance costs as a primary challenge, making it the second-most important concern after the fiscal cliff.

Inventories are expected to decline by 1.5% over the next year, with 46% of respondents saying that their inventory levels would stay the same. Meanwhile, the prices for final goods are anticipated to increase by 1.5% on average, slightly above the 1.4% gain suggested last time.

Note: Expected growth rates are annual averages.

More than 44% of manufacturers plan to keep their prices about the same, with around 36% suggesting final price increases of up to 5%. Almost 8% expect to lower prices. In terms of overall pricing pressures, 39.6% of manufacturers worry about rising energy and raw material costs for their products.

More than 40% of manufacturers cited increasing international sales as one of their primary drivers of growth. Illustrating the importance of overseas markets, firms that were anticipating higher exports over the next year tended to be more optimistic about their overall business outlook. In fact, two-thirds of these export-increasing firms were positive about their outlook versus just 45.2% of those who anticipated slowing or no change in their export sales.

Note: Respondents were able to check all that apply. Therefore, responses exceed 100 percent.

The slowdown of the global economy is a major challenge for the manufacturing sector, which depends heavily on exports for growth. Recent weaknesses have slowed the growth rate of exports, as we have seen in official government data. Here, too, we can see an impact. Export sales are expected to grow 0.7% in the next 12 months, down from an anticipated 1% growth in September and 1.3% gain in March. Even with an easing in the pace of export growth, more than 30% of manufacturers expect them to increase over the next year. Roughly 59%anticipate no changes in their export levels.

Note: Respondents were able to check all that apply. Therefore, responses exceed 100 percent.

As is often the case, firm size heavily influences these findings. Smaller manufacturers (e.g., those with fewer than 50 employees) were less positive than their medium-sized (50 to 499 employees) or larger (500 or more employees) counterparts. In fact, 57% of small manufacturers said that they were negative in their outlook, compared to 44% of medium-sized businesses and 47% of large businesses. Slower sales growth was largely the main factor, with small firms expecting their sales to increase just 0.5% over the next 12 months. Larger manufacturers forecast the largest increase in sales, up 1.6% for the next year. As a result, small and medium-sized manufacturers were negative in their intentions for capital spending, whereas larger firms were positive. Manufacturers of all sizes had lower hiring plans at essentially the same rate.

Note: Respondents were able to check all that apply. Therefore, responses exceed 100 percent.

The top challenge for manufacturers—cited by 84.2% of respondents—was uncertainty related to the political climate. With potential tax increases and budget cuts looming at the beginning of 2013, businesses are following the political stalemate in Washington closely, as they were before the election. This was the top concern in September’s survey as well, when it had 78.7% of the responses. Many of the comments that were offered also centered on the fiscal cliff and possible sequestration in the discretionary budget. A sampling of these comments appears later on.

In a series of special questions, we were interested in learning more about manufacturers’ reactions to the election and their policy priorities for the coming year. One thing was certain: businesses are highly skeptical that Washington will be able to address the nation’s long-term fiscal challenges, with almost three-fourths of respondents saying that the election made them less optimistic for such a deal. Moreover, only 7.5% of manufacturers anticipate that the President and Congress will enact a “grand compromise” during the lame-duck session that will avert the fiscal cliff, with roughly 28 percent feeling that the fiscal cliff will not be averted. Another 48 percent feel that the cliff would be averted by delaying the tax increases and budget cuts by a few months to a year, and almost 16% were uncertain as to whether or not the fiscal cliff would be averted or not.

Note: Respondents were able to check all that apply. Therefore, responses exceed 100 percent.

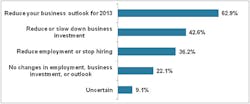

It should be no surprise that manufacturers’ optimism has declined, or that so many have downgraded their forecasts for 2013. Nearly 63% of respondents said that they have reduced their business outlook for next year as a result of uncertainties surrounding the fiscal cliff . Even more worrisome, 42.6% have either reduced or slowed down their business investment, and 36.2% have either reduced their employment or stopped hiring. These impacts were even larger for small manufacturers with fewer than 50 employees, where two-thirds have reduced their outlook, and 45% and 42% have reduced their investments and hiring, respectively.

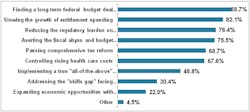

We also asked manufacturers about their most pressing priorities for the second Obama term and the upcoming 113th Congress. Budgetary issues dominated the list, as might be expected. Almost 89% wanted the top priority to be a long-term budget deal that tackles the deficit and debt . Slowing the growth of entitlements (82.1%) and averting the fiscal cliff (75.5%) were also high on the list. At the same time, manufacturers want to ensure that the overall business climate is strong and competitive globally. You can see this with the desire for reducing the regulatory burden (76.4%), passing comprehensive tax reform (68.7%), controlling rising health care costs (67.6%) , implementing a true “all-of-the-above” energy policy (48.8%), addressing the “skills gap” (30.4%) and expanding trade agreements (22%).

Of course, each of these items is important for manufacturers, with some being more dominant than others. For instance, while having more trade agreements ranks last in this ordinal ranking, it would be hard to say that it is not vital for the sector. In fact, nearly 41% of our respondents said that increased international sales were crucial for future growth. As mentioned earlier, those manufacturers who were more positive about increased export sales tended to be more optimistic in their overall outlook. Also, the issue of attracting and retaining a quality workforce has become an almost universal mantra for manufacturers and businesses of late. In a recent survey of small and medium-sized manufacturers, more than 63% said that they were having difficulty filling their open positions.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997. This survey was conducted among NAM membership between November 16 and 31, 2012, with 442 manufacturers responding. Responses were from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear on the following pages. The next survey is expected to be released in March 2013.

About the Author

Chad Moutray

Chief Economist, National Association of Manufacturers

Chad Moutray is chief economist for the National Association of Manufacturers, where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews and has appeared on various news outlets. In addition, he is the director of the Center for Manufacturing Research at The Manufacturing Institute, the workforce development and education partner of the NAM, where he leads efforts to produce thought leadership, data and analysis of relevance to business leaders in the sector.

Prior to joining the NAM, Mr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Mr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago (now part of Roosevelt University). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an M.B.A. program that began accepting students after his departure and created a business institute for students to work with local businesses on classroom projects and internships.

Mr. Moutray is the vice chair of the Conference of Business Economists, and he is a former board member of the National Association for Business Economics, where he is the co-chair of the Manufacturing Roundtable. He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C.

He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. He is a Certified Business Economist™, where he was part of the initial graduating class in 2015.

In 2014, he received the Outstanding Graduate Alumni Award from EIU, and in 2015, he accepted the Alumnus Achievement Award from Lake Land College in Mattoon, Illinois, where he earned his associate degree in business administration. He serves on the external economics advisory board for the SIUC’s School of Analytics, Finance and Economics.