Make Your Move: Signs Point to Slowdown in Chemical Production

Thus far, 2014 has not started out with very encouraging news. The stock market declined in January from December; light vehicle retail sales stumbled; and the pace of ascent in housing starts slowed further. In addition, the Purchasing Managers Index (PMI), a measure of expansion in the manufacturing sector, dropped precipitously in January.

The downturn in the PMI is consistent with our view that growth in the U.S. economy will slow later this year. Don't let this deter you from seeking out opportunities for growth -- use this year to make investments in capital and people that will allow your firm to profit from the growth we see in 2015 and beyond.

One of the key drivers of this growth will be America's increasing energy independence. In 2013, 32.3% of domestic oil consumption was from imported oil. This is down markedly from 2005, when it was 60.3%. Moreover, the shale gas boom has made the U.S. the world's top producer of cheap natural gas. Cheaper (and more plentiful) natural gas will be a boon to the chemical industry and many other sectors of the U.S. economy.

Construction of new chemical plants has been robust over the last year. Private chemical construction ended 2013 at a record-high $17.7 billion, 65.5% above the previous year's level. Dow Chemical Co. (IW 500/25), the largest U.S. chemical producer by revenue, is planning to build a $4 billion ethylene and propylene plant on the Gulf Coast in order to take advantage of low-cost natural gas. Ethylene and propylene are chemical intermediates that are building blocks of many chemical and plastic products.

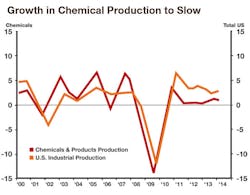

While the longer-term outlook for the chemical industry is bright, an important leading indicator in the sector is suggesting that a production lull may develop later this year. The American Chemistry Council's Chemical Activity Barometer, which leads chemical production by seven months, is a composite index of the chemical sector. It is 3.1% above the year-ago level and at a 60-month high, so everything looks great on the surface. However, utilization of a rate-of-change methodology shows that the barometer is signaling downside business cycle pressures in this industry. The input is consistent with our forecast for the chemical sector as a whole.

Currently, U.S. chemical production is 1.2% above the previous-year level (average annual basis). We expect the growth in production to ease through the year as demand from some key end markets slows (think housing, automobile production, and consumer goods). But this will be a short-term phenomenon. The growing economy in the latter half of 2015 will provide a boost to the chemical industry.

The annual paint and coating production index sits at a 65-month high and is 10.1% above the year-ago level. Production on a quarterly basis is 11.6% higher than last year; the healthy activity last quarter suggests more good news in the annual production figures in the coming months. Paint production has been supported by the rising trends in housing starts, home improvement spending, and automobile manufacturing. These sectors are expected to cool in late 2014.

Agricultural chemical production is nearing a three-year high, 8.0% above last year (annual basis). Trends in the underlying data tell us that production in this subsector should continue to trend higher. We anticipate that the growth in U.S. food production will accelerate toward the end of the year and into 2015. This will be supportive of higher levels of agricultural chemical production.

|

Stay up-to-date with economic news and trends on Alan Beaulieu's Make Your Move blog at iw.com/blog/make-your-move.

|

The broader U.S. economy and chemical production are expected to slow later this year. This may result in your cash flow slowing, so be prepared to use cash wisely. Temper that concern, however, with the knowledge that stronger growth will return in the second half of 2015. Invest wisely in the people and equipment that will allow you to profit from that growth.

Contributing Editor Alan Beaulieu is an economist and president of ITR (itreconomics.com). He is co-author, with his brother Brian, of “Make Your Move,” a book on spotting business-cycle trends.