MAPI Predicts 'Broad-based Growth' for US Manufacturing

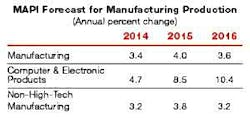

Manufacturing production will grow 3.4% in 2014, outstripping the broader U.S. economy, and will pick up the pace in 2015, according to the latest quarterly outlook report from the MAPI Foundation.

The 3.4% projected increase for 2014 is an increase from MAPI’s June forecast of 3.2% growth. Factory production grew at a 4% annual rate in the first half of 2014, MAPI noted, while inflation-adjusted GDP grew at a 0.9% rate.

MAPI predicts that manufacturing production will increase 4.0% in 2015 and 3.6% in 2016.

“The proximate cause for faster industrial growth is that demand has shifted toward manufactured goods,” said MAPI Foundation Chief Economist Daniel J. Meckstroth, Ph.D. “Durable goods, equipment, and construction have long lives and therefore are temporarily postponable, especially during economic downturns and times of uncertainty.” He noted that the rebound in big-ticket consumer spending is supported by employment gains, households’ low debt burdens and rising consumer wealth.

According to its September forecast, 23 industries will see growth in 2014, while three will remain flat. Only paper production will experience a decline this year.

MAPI expects all 23 industries to grow in 2015, led by housing starts at 29% and aerospace products and parts at 10%. Meckstroth’s initial forecast for 2016 again shows all 23 industries advancing, with housing starts up 18%, electric lighting up 13% and private nonresidential construction up 12%.

From May through July of this year, MAPI found, 20 of the 27 industries it monitors had inflation-adjusted new orders or production at or above the level of a year ago, while five declined and two were flat.

In August, industrial production fell 0.4%, the Federal Reserve announced yesterday. However, economists noted that the decrease was due almost entirely to a 7.6% decline in the auto sector. Chad Moutray, chief economist at the National Association of Manufacturers, said on NAM's Shopfloor blog the decline was “likely the result of auto makers’ switching over to a new model year and summertime vacations.”

Moutray said the auto production drop in August was a “pause” in an upward trend, not weakness in the sector, and noted that without motor vehicles, “manufacturing production would have increased 0.1%.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.