Hazards ahead: That’s what data about the auto sector are signaling. Economic leaders and workers may want to buckle up.

Caution lights are definitely blinking for the auto industry—and the manufacturing sector more generally. This month, the Brookings Institution’s new update on growth and change in America’s 50 critical advanced industries showed that output growth slowed markedly in the three major auto industries during the last two years while employment growth—still positive—leveled off.

Meanwhile, sales for the three top automakers selling in the U.S. slipped in July as the strong growth rate that has defined the past six years slowed to a crawl—another indication that growth is plateauing after a six-year boom. A few weeks ago Ford jolted the industry by saying sales have peaked and projecting a slower fall and a tough 2017.

This is a sea change, given the boom since 2010, and it matters a lot right now because auto is critical to the manufacturing sector, which itself matters enormously to the U.S. growth in manufacturing-oriented metropolitan areas.

Auto-related industries, after all, delivered fully 70% of the nation’s advanced manufacturing employment growth during the last two years, given the slow growth other manufacturing industries experienced in the face of a strong dollar and global headwinds. In keeping with that, the sector has become a crucial source of innovation, output, productivity, and new jobs (90,000+ “direct” ones in the last two years).

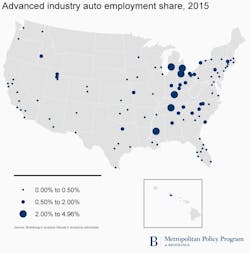

As such, auto industries—with their long supply chains—contribute hugely to the prosperity of something like a quarter of the nation’s largest metropolitan areas, arrayed along a corridor sweeping from the Great Lakes states into Kentucky, Tennessee, South Carolina, and Alabama. Immediately below you can see the distribution of large metro areas with elevated shares of their employment in auto. It’s a significant swath of the country’s Midwestern and Southern heartland.

All of which underscores that a further slowing of the auto sector—as appears to be beginning—could be an unfortunate development for the nation’s steady but uninspiring economic expansion. The auto industry’s recovery has been a bright spot for the U.S. economy, with the three major auto industries and four digital services delivering two-thirds of the nation’s vital and sustaining advanced-sector growth. If that goes away, the nation’s advanced sector and multiple states and metro areas will have to contend with a further narrowing of an advanced-sector growth base that is already too narrow.

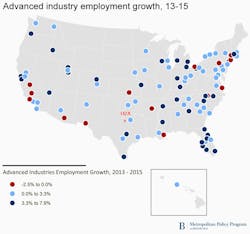

Losing auto as a strong job creator would for one thing take away one of the nation’s few sizable sources of well-paying jobs for workers without a bachelor’s degree. The auto industry and other manufacturing industries are notable for continuing to pay decent wages to less-educated workers. The nation needs more growth from its most accessible high-value industries, not less! Similarly, a slowing of the auto sector would narrow the geography of growth across multiple heartland states and metropolitan areas. More dots would turn pink or red on the advanced industry employment growth map as hiring slowed. More regions would lose direct jobs, supplier jobs, and consumer spending.

In that vein, a flattening of growth in the auto sectors could well emerge as a substantial issue in the first year of a new president’s administration. Momentum should keep hiring going through the election and keep a plateauing auto sector from worsening the distress already agitating the electorate in “battleground” states like Michigan and Ohio. But should auto growth slump and the mediocre 1.2% a year growth rate of the manufacturing sector slip further, the new president is going to be forced to address the status of the nation’s advanced-industries sector. Further slowing will make shoring up and expanding the advanced-industries sector even more imperative than it already is.

Mark Muro, a senior fellow and director of policy for the Metropolitan Policy Program at Brookings, manages the program's public policy analysis and leads key policy research projects.

This article originally appeared in Brookings’ The Avenue blog.