'Thriving' Manufacturers Still Looking for a Boost from Washington

A survey of manufacturers in the middle market shows that continuing confidence amongst U.S. consumers and global economic growth are helping to fuel an upbeat mood amongst American manufacturers, reports RSM US, an audit, tax and consulting firm.

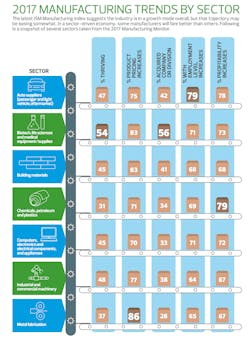

Some 43% of executives surveyed described their companies as “thriving,” a small increase from 2016. RSM’s Manufacturing Monitor Survey included 660 leaders in manufacturing companies with revenues between $10 million and $1 billion. The sectors leading the thriving category were: biotech, life sciences and medical equipment/supplies (54%), industrial and commercial machinery (48%) and auto suppliers (47%). Less optimistic were metal fabricators (37%) and chemicals, petroleum and plastics manufacturers (30%).

“Seventy percent of our $19 trillion economy is driven out of the consumer and the consumers are still buying,” says Steve Menaker, a partner at RSM and the national consumer & industrial products industry leader. He says that confidence directly impacts manufacturers. He added that manufacturers’ confidence was also likely to be bolstered by more action on public policy issues such as health care, taxes and infrastructure.

“A good business owner of any size really wants to understand the playing field, and I think there's just a few balls up in the air right now that we'd love to see settled,” Menaker said.

Some 65% of middle market leaders said their companies had increased employment and many expected further gains in the months ahead. Attracting the right workforce will be a continuing challenge for manufacturers. Said Menaker, “I know at least over the next 10 years that that problem is not going to get solved.”

He related a conversation with a CEO who said finding skilled employees was not his company’s only concern. “Our challenge is that once we get people trained, we've then got people poaching our employees,” he told Menaker.

RSM found most respondents expected to increase revenues in the coming months, with just over a third (36%) anticipating a healthy increase of 11% or more. Nearly half of the executives surveyed reported operating profits of 6% or more, before interest and taxes. While their costs for components and materials are on the rise, about three-quarters of manufacturers plan to pass those increases on to their customers. Menaker said these price increases are adding to profits, not just going to rising expenses. He said the ability to increase prices is being helped by demand from improving economic conditions in Europe and many parts of the developing world.

Two-thirds of manufacturers plan to increase their investments in technology. Menaker said where companies have straightforward decisions about machinery that can increase throughput and quality, investment decisions are easier to make. But when it comes to making decisions around the Internet of Things and data analytics, he said, manufacturers may find that a “much harder decision to both rationalize and implement.”

Menaker said large manufacturers have the skill and resources to make decisions about new technologies but at the smaller end of the scale, companies may be less certain about how to proceed and face proportionately larger investment decisions. That is reflected in RSM findings, where 54% have yet to implement IoT and 64% are not using additive manufacturing. However, 62% are using eCRM in their facilities.

Manufacturers also continue to put a high priority on improving their operations. Almost half of the executives surveyed by RSM said they would be investing in process improvements.

How do manufacturers expect to grow in the next year? The two leading ways, executives told RSM, will be through introducing new products and expanding in domestic markets. The next top three avenues were: enter new domestic markets, expand their presence in existing international markets and improve existing products.

Public policy will play an important role in how middle market manufacturers approach investment. Menaker, a member of the National Association of Manufacturers’ board of directors, said at the most recent board meeting, there was widespread belief that more certainty about tax reform would help manufacturers make decisions about investments that have been on hold because of continuing inaction on tax policy.

Menaker said other policy decisions by the Trump team were contributing to manufacturers’ confidence. He cited efforts to scale back environmental regulations and to rein in the National Labor Relations Board and its union-friendly decisions from the Obama administration.

While manufacturing hiring is rising, Menaker agrees with most observers that manufacturing is becoming more automated and it is unlikely that there will be a massive increase in U.S. employment. However, he noted that if manufacturers could just find employees to fill the existing open positions, it would provide “a nice bump in manufacturing employment.”

About the Author

Steve Minter Blog

Executive Editor

Focus: Global Economy & International Trade

Email: [email protected]

Follow on Twitter: @SgMinterIW

Call: 216-931-9281

An award-winning editor, Executive Editor Steve Minter covers global economic and international trade issues, tackling subject matter ranging from manufacturing trends, public policy and regulations in developed and emerging markets to global regulation and currency exchange rates. As well, he supervises content production of all IW editorial products including the magazine, IndustryWeek.com, research and informationproducts, and executive conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two children.