From an energy cost perspective, we are now in a new world. The recent run up in energy costs over the past 20 months and associated volatility marks the first time we have encountered a true demand driven energy crisis. Historically, price spikes have been caused by supply disruptions, but this time we are facing the law of large numbers, as applied to the elevation of a significant portion of poor citizens to middle class in countries such as India and China. Looking at it another way, when T. Boone Pickens is promoting wind energy, times have truly changed.

As the world dynamics of population growth and economic development continue to change, we see that they inevitably drive toward a single concern: economic growth requires energy, and energy consumption, in its current form equals greenhouse gas emissions. The elevation of huge populations (China, India) from third-world to aspiring first-world status puts tremendous pressure on everyone with respect to greenhouse gas emissions, and hence the two pronged effect on established business enterprises: higher energy costs and increasing political/regulatory pressure on GHG emissions.

Most companies are not prepared for the ripple effects from this trend. Shifts in product design, raw material usage, facility location, supply chain network design and many other areas of corporate decision-making will move in new and challenging directions as the impact of high energy prices and GHG emissions trickle throughout the entire value chain.

This ripple effect is already affecting several major contract manufacturing service providers, which have dominated electronics production for the past several years. These service providers are now under increasing pressure to find new sources of revenue growth, more regionalized production facility structures, and cost reduction targets driven in part by rising energy costs.

Political/Regulatory Pressure

Based upon the stated policy positions of President Obama, U.S. government regulation of carbon emissions will be a priority for the new administration. In fact, at the state level, government has already taken steps to hold companies liable for GHG reduction.

At the highest level, the goal for companies is to increase the output of economic value at a greater rate than the output of greenhouse gases. Or, more precisely, the economic value, over time, should increase relative to the economic value created; efficiency needs to improve over time. With industries that emit high levels of GHG (e.g. Utilities, Oil & Gas, Metal, Mining, & Steel) and are under increasing regulatory pressure and public scrutiny, increased efficiency will result in immediate and lasting bottom-line savings.

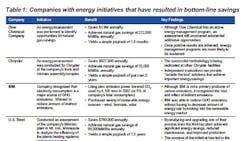

Certain industries are at greater risk relative to others, and these same industries also stand to gain the most by quickly addressing and resolving GHG emission issues. Companies that have aggressively and proactively addressed energy initiatives include: 3M, Caterpillar, Home Depot, Pfizer and many others.

A Plan for Action

Companies that are under cost and/or regulatory pressure should develop a comprehensive approach to Active Carbon Management, that evaluates and benchmarks current and historical energy use and GHG impact, addresses key value chain issues, and aligns with the goals of shareholders and senior management. In the larger context all companies should engage three basic concepts into their carbon cost reduction framework:

- Attack Immediate Energy Cost Reduction Opportunities through Active Carbon Managementsm Process

Secure sponsorship for Active Carbon Managementsm from senior level management and drive the process through the entire value chain. Create an inventory of energy costs. With a current cost benchmark in place you can build your future cost picture and tie gaps and opportunities directly to achievable results. - Prepare for GHG Driven Regulations and Markets

Define metrics that anticipate future industry regulations and markets, that consider competitive forces from industry peers and that incorporate future company growth and carbon reduction capabilities. Define a baseline and build in future flexibility to protect against volatility in regulations and instability in the markets. Build a reporting model that tracks progress against the baseline and provides visibility to quick win accomplishments to help spotlight successes and gain further executive support. With metrics, a baseline and a reporting model in place establish a governance model to establish roles and responsibilities and a reporting structure that communicates results to management and shareholders. - Monitor and Improve Based on Shareholder Return

As cost reduction opportunities are identified and executed throughout the value chain continue to identify new opportunities and improve upon current successes. Continue to monitor the regulatory environment and adjust current plans according to new regulations and market information.

The combined effect of high energy costs, rapidly growing global demand for energy, and public acceptance of GHG regulations and control will have far reaching effects on businesses. The proper response for business organizations is to establish a comprehensive baseline understanding of current energy consumption and GHG emissions, and develop plans to measure, reduce, and report, thus taking control of a process that is likely to be very expensive if these tasks are left to regulatory agencies or if organizations wait until shareholder pressure drives action.

For a more comprehensive version of this article, please go to www.archstoneconsulting.com