There is a lingering perception that China is relatively lax about environmental problems in its manufacturing sector. But more and more, that's a dated notion, ignoring the significant steps taken by China in the last year or so to address its green shortfalls, such as higher factory emission standards, an emphasis on developing renewable energy technologies, and stricter oversight of potential polluters. Indeed, China has partners in this endeavor: Increasingly, multinational manufacturers with factory operations in China are bringing their green ideas to the Asian nation.

Recent statistics support this trend. In a late 2009 survey of more than 200 foreign multinationals in China conducted by Booz & Company and the American Chamber of Commerce in Shanghai (AmCham Shanghai), three-quarters of respondents said they were adopting green technology in their Chinese operations and 60% anticipated savings in operations from their green investment. Moreover, 62% of the companies said they actually quantify the magnitude of the potential effect on their business from carbon, water, or other environmental constraints.

Most large Western companies these days view going green as an imperative, not an option, as they face calls from customers, regulators, shareholders, partners, and directors to reduce their carbon footprint and the impact of their operations on the environment. And while green strategies are socially responsible, equally important is that they can lower costs, minimize energy sticker shock, and potentially provide new revenue and profit streams. Many organizations find manufacturing operations a good place to start environmentally conscious initiatives, primarily because even before green became fashionable, production systems were focused on improving efficiencies and reducing resource consumption.

The appropriate environmental commitment varies widely among companies and among industries. But generally there are three prevalent green strategies (from simple to complex):

- Responsible: Seeks to meet the basic sustainability demands of key stakeholders, such as trade customers and regulators, and maintain the company's competitive position. Initiatives tend to be focused on compliance.

- Efficient: Pursues operational efficiency and cost competitiveness through environmental approaches that also leverage lean principles. The goal is chiefly to provide cost savings, with revenue opportunities viewed as a possibility down the road.

- Differentiated: Elevates environmentally sound behavior from a social responsibility to a core operating model by placing a "green lens" on the entire product life cycle and integrating green messaging into brand positioning and communications. With this substantial effort, green strategies are the source of long-term business value and enhanced market share.

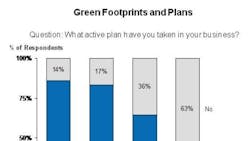

Most multinationals in China are taking the middle path (see figure below). For example, 86% of survey respondents said they were trying to increase energy efficiency and 83% said they were conserving or recycling water-fossil fuel and clean water are at a premium in China. In addition, 64% indicated that they were recycling waste.

Source: China Manufacturing Competitiveness Study 2009-2010; Booz & Co. Analysis

But beyond these cost-cutting moves, few showed much enthusiasm for more consequential (and difficult) green approaches at this point. Indeed, 63% of multinationals said reducing their carbon footprint was not a motivating factor in their environmental programs. Moreover, only 35% of companies had calculated their carbon footprint; 37% had measured their impact on local water supplies. To be fair, carbon reduction in China is challenging because a large percentage of energy in the country is derived from coal-fired plants, which lack effective scrubbers and are among the dirtiest in the world, and China is such a vast global supplier that its sheer reach substantially amplifies its carbon footprint.

As the efficient green strategy proves its value and as Chinese leaders and consumers become more demanding about sustainability and environmental sensitivity, multinational manufacturers are more than likely to move toward a differentiated approach. Currently, however, few of them see a payoff from such a potentially expensive and complicated campaign. Although the cost of manufacturing and the price of goods are rising in the country, it is still too early in China's emergence as an economic power for a multinational to anticipate a consistent top-dollar (or, in this case, renminbi) return for unique products that meet high environmental standards. By contrast, the expectation of such a return drives differentiated strategies in the West. Only 30% of survey respondents said they could demand higher prices for green products and services in China, compared to 46% of companies that said they do so in other markets around the world.

The Booz & Company/AmCham Shanghai survey paints a much more nuanced-and rosy-picture of environmental conditions and prospects in the manufacturing community in China than is generally perceived. While multinationals have clearly helped the country improve its green record, China has changed its own behavior significantly, and it is probable that the continuing sustainable activities of domestic and foreign manufacturers will dovetail perfectly with China's own commitment to a cleaner future during the next decade. As this partnership evolves, the lucrative gains from green -- in both quality of life and company performance -- will make this period of gestation worth the painstaking effort.

(For an in-depth analysis of multinational activities in China, see the third annual China Manufacturing Competitiveness Study 2009-2010, published in March 2010 by Booz & Company and the American Chamber of Commerce in Shanghai. www.booz.com)

Stephen Li and Arvind Kaushal are Principals at Booz & Company.