Why Manufacturing is Critical to California's Economy

For every one job created in manufacturing, at least two to three jobs are created to support the sector. Further, manufacturing firms create regional wealth by producing a product that is exported to other states and countries. This attracts additional funds to the region — creating business, individual and community wealth. Because of this ripple effect, manufacturing firms have a deeper impact on the state of the economy than most other industries.

California is the number one state for manufacturing jobs, firms and output – accounting for 11.7% of the total U. S. output, and employing 9% of the U. S. manufacturing workforce. California manufacturing generates $229.9 billion, more than any other state. Manufacturing is California’s most export-intensive activity contributing significantly to California's $159 billion in exports in 2011. Overall, manufacturing exports represent 9.4% ($120 billion in goods) of California’s GDP, and computers and electronic products constitute 29.3% of the state’s total manufacturing exports. More than one-fifth (21.9%) of all manufacturing workers in California directly depend on exports for their jobs.

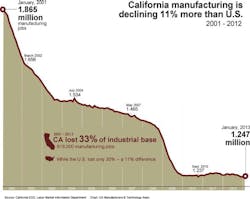

Since January 2001, the manufacturing sector lost 33% of its job base, down from 1.86 million jobs in 2001 to 1.237 million jobs in 2010. In 2010, the manufacturing sector began adding employment, regaining 7,900 jobs. California exports have also increased — up from $104 billion of manufactured goods in 2009 to $124 billion in 2010.

A 2011 report by the Center for Applied Competitive Technologies (CACT) at El Camino College and the Center Of Excellence (COE) of the Los Rios Community College District identified the following 17 cluster industries in California:

- Aerospace Manufacturing

- Biotechnology, Medical Devices, & Pharmaceutical Manufacturing

- Building Materials Manufacturing

- Chemical Manufacturing

- Computers/Electronics Manufacturing

- Dental Equipment, Supplies & Laboratories Manufacturing

- Fashion/Clothing Manufacturing

- Furniture Manufacturing

- Household Products Manufacturing

- Machinery Manufacturing

- Metals Manufacturing

- Paper Products Manufacturing

- Petroleum Manufacturing

- Plastic Products Manufacturing

- Printing and Publishing

- Transportation Manufacturing

The report states, “With the exception of food manufacturing, biotechnology, dental equipment, and petroleum, nearly every manufacturing cluster in California has shed jobs over the last five years [2006-2011.] Building materials lost the most jobs with a decline of 32%, followed by printing (22%), and computers/electronics (10%).”

Challenges Facing CA Manufacturers

The report states that the “manufacturing sector must address a variety of challenges, from navigating a complex regulatory environment to developing strategies to compete with low cost economics. There are a number of factors that have inhibited the manufacturing sector’s ability to compete locally and internationally.” Some of these challenges are:

- California’s regulatory climate is difficult, expensive and time consuming to navigate

- Higher health care expenditures compared to countries where health care is paid for by general tax revenues

- Higher salaries and other benefits, such as paid leave, insurance, and retirement plans

- Higher costs associated with litigation claims

- Higher costs associated with environmental compliance;

- Higher corporate tax rates than most other countries (the United States’ tax rate is 40%, the second highest tax rate among major trading partners.)

Opportunities

Competition from low-cost economies, such as China, India, Singapore, South Korea, Thailand, and Vietnam, is one of the major challenges faced by the manufacturing sector. However, the total cost of outsourcing to other countries is often miscalculated. According to the Reshoring Initiative, the true cost of manufacturing outside of the United States does not include costs associated with:

- National policy issues (trade negotiations, etc.)

- Changes in currency exchange rates

- Intellectual Property theft

- Supply chain disruptions

- Lengthy delivery times

- Traveling to the manufacturing site to assess and resolving production issues

Further, in the last few years many countries have started to raise their prices to adjust for increases in wages and higher transportation/fuel expenses. By examining the total cost of outsourcing, the Reshore Initiative argues that hiring local production firms is just as price sensitive as hiring firms from low-cost economies. Also, there are several benefits to working local, such as:

- Improved quality and consistency of inputs

- Ability to create just-in-time operations that reduce inventory and shipping costs and improve business-to-business relations

- Intellectual property security

- Faster delivery to customers

As this viewpoint has gained popularity, it has started to shift production back to the United States, creating jobs and wealth in the process. By 2013, the Reshoring Initiative estimated that about 80,000 jobs returned to the United States by reshoring, about 15% of the nationwide increase of 526,000 jobs since 2010.

Four Recommendations to Improve the Business Climate

For several years, I have been writing about my own prescription for what needs to be done to improve California’s business climate. Here are my top four suggestions:

- Lower taxes - reduce the corporate and personal income tax rates by about three to four percent, to be competitive with other states.

- Restore the capital equipment investment tax credit - the legislature repealed the capital equipment investment tax credit in 2003, which penalized companies for investing in the future.

- Reform workers’ compensation to address the issues of fraudulent claims and frivolous lawsuits and reduce workers' compensation rates. Even after the reforms in 2004, California still has the 6th highest rate nationwide.

- Eliminate burdensome regulations on small businesses

We need to make some drastic changes in California’s business climate so that we can eliminate barriers to success and create incentives for production in California, encourage growth, and maintain as much as possible of our manufacturing base in California. If business and government would work together, we could restore California to the Golden State it once was.

About the Author

Michele Nash-Hoff Blog

President

Michele Nash-Hoff has been in and out of San Diego’s high-tech manufacturing industry since starting as an engineering secretary at age 18. Her career includes being part of the founding team of two startup companies. She took a hiatus from working full-time to attend college and graduated from San Diego State University in 1982 with a bachelor’s degree in French and Spanish.

After graduating, she became vice president of a sales agency covering 11 of the western states. In 1985, Michele left the company to form her own sales agency, ElectroFab Sales, to work with companies to help them select the right manufacturing processes for their new and existing products.

Michele is the author of four books, For Profit Business Incubators, published in 1998 by the National Business Incubation Association, two editions of Can American Manufacturing be Saved? Why we should and how we can (2009 and 2012), and Rebuild Manufacturing – the key to American Prosperity (2017).

Michele has been president of the San Diego Electronics Network, the San Diego Chapter of the Electronics Representatives Association, and The High Technology Foundation, as well as several professional and non-profit organizations. She is an active member of the Soroptimist International of San Diego club.

Michele is currently a director on the board of the San Diego Inventors Forum. She is also Chair of the California chapter of the Coalition for a Prosperous America and a mentor for CONNECT’s Springboard program for startup companies.

She has a certificate in Total Quality Management and is a 1994 graduate of San Diego’s leadership program (LEAD San Diego.) She earned a Certificate in Lean Six Sigma in 2014.

Michele is married to Michael Hoff and has raised two sons and two daughters. She enjoys spending time with her two grandsons and eight granddaughters. Her favorite leisure activities are hiking in the mountains, swimming, gardening, reading and taking tap dance lessons.