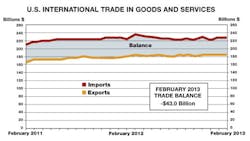

The U.S. trade deficit fell to $43 billion in February, supported by increasing domestic shale oil production that is driving down petroleum imports, the U.S. Commerce Department reported today.

Exports totaled $186 billion in February, up from $184.4 billion in January. Imports rose slightly to $228.9 billion, a gain of only $0.1 billion from January.

The smaller trade gap surprised analysts who had expected it to grow to $44.6 billion on the strength of a higher import total.

The trade deficit in manufactured goods improved in February to $45.4 billion from $54.9 billion in January. For the first two months of 2013, the trade deficit for manufactured goods was $100.3 billion, up nearly $3 billion from the corresponding period in 2012.

“Gains in merchandise exports were apparent in the Africa, Brazil and Pacific Rim NICs and were concentrated in industrial supplies and autos,” commented Michael Dolega, an economist with TD Economics. “This is in line with our expectation for a gradual shift of exports toward the faster growing South/Central America and Sub-Saharan Africa. However, EU-destined exports continued to decline, highlighting economic malaise on the sub-continent, further intensified by the recent Cypriot bailout and subsequent capital controls.”

The U.S. trade deficit with China narrowed to $23.4 billion in February from $27.8 billion in January.

"The fact that the U.S. trade balance narrowed is good news, but much of the shift in the data stemmed from petroleum flows," observed Chad Moutray, chief economist of the National Association of Manufacturers in its Shopfloor blog. "Outside of petroleum, exports were up less dramatically. Manufactured goods exports, on a non-seasonally adjusted basis, totaled $183.78 billion in the first two months of 2013, or 2.45% higher than the $179.38 billion seen in January and February 2012. That suggests very slow growth in manufactured goods exports, and increases well below the 15% required to double exports by 2015. In 2012, manufactured goods exports rose 5.5% using seasonally adjusted data, which was below the 15.9% growth rate seen in 2011."

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.