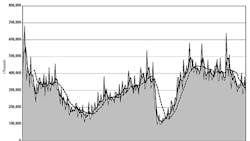

U.S. machine shops’ and other manufacturers’ new orders of metal cutting and similar manufacturing technology totaled $284.10 million during April, declining 25.5% from March, and falling 27.5% from the April 2015 result. The latest monthly total brings the year-to-date value of new machine tool orders to $1.23 billion, which is down 16.6% compared to the January-April 2015 report.

“The current conditions for manufacturing technology providers are a reflection of larger stagnation in manufacturing and the overall economy – some industries are performing well, and others are struggling,” stated president of AMT – the Association for Manufacturing Technology.

AMT’s monthly U.S. Manufacturing Technology Orders report summarizes actual totals for machine tool orders reported by participating companies that produce and distribute metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment.

The USMTO is used as a forward-looking indicator of manufacturing capital investment, as companies place orders for new equipment to increase capacity and to improve current capabilities.

As such, the “slow growth” pattern in most major U.S. industries has impacted the manufacturing technology sector in a sustained way.

“Automotive and aerospace, which mitigated the market decline for the last 15 months of the current downturn, continue to hold their own but they aren’t growing,” according to AMT’s Woods. “Some industries are growing, such as consumer electronics, firearms, and medical, but those represent only 12 percent of our overall market. Weakness continues in the oil and gas and construction/off-road industries.”

American Machinist is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)