How Could the Trans-Pacific Partnership Affect You or Your Business?

On February 4, 2016, President Obama signed the Trans-Pacific Partnership agreement on behalf of the United States. The TPP agreement has been in negotiation behind closed doors since 2010 between the United States and 11 other countries around the Pacific Rim: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. The TPP is a “docking agreement” so other countries could be added without the approval of Congress. India, China, and Korea have expressed interest in joining the TPP.

Our elected representatives in Congress had no involvement in writing the TPP – it was written by the staff of the U. S. Trade Representative office, with over 600 corporate advisors (think corporate lawyers) helping them write it. It contains more than 5,500 pages, and no member of Congress could view it as it was being negotiated until late 2014. Even then, they could not take any staff with them and were not allowed to take pen, pencil, paper or a camera when they went to view it at the USTR's office.

The full text of the TPP was finally released to the public to review in November 2015, and it now awaits Congressional approval. According to the rules established by the Trade Promotion Authority (TPA) that passed Congress narrowly in June 2015, Congress will only be allowed 45 days for committee analysis after the bill is introduced, only 15 days after that is completed to bring it up for a floor vote, and only 20 hours of debate in the House and Senate. The TPA does not allow any amendments, filibuster, or cloture. Notice that the TPP is called an "Agreement," as was NAFTA, CAFTA, KORUS, and every other trade deal in the past 22 years. The purpose for this is to get around the requirement of the two-thirds vote of the Senate to approve a treaty that is required under Article 1, Section 8 of the Treaty clause in the U. S. Constitution. The TPP requires only a simple majority vote (50% + one.)

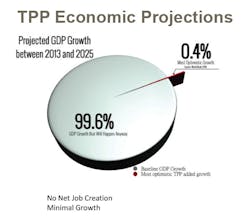

Supporters of the TPP say that it represents 40% of the world's economic activity (GDP), but they fail to mention that the U.S. and its current trading partners represent 80% of that 40%. The other five countries represent the other 20%, with Japan alone being 17.7% of that total.

The current goal of trade agreements as given by Congress to the USTR is to "remove trade barriers," such as tariffs, quotas, etc. and increase U. S. exports. The U.S. cut tariffs and opened our markets by means of these trade agreements. However, our trading partners didn't really open their markets to us. They played another game ─ mercantilism, featuring rampant global currency devaluation, consumption taxes called Value Added Taxes (VATs) that are tariffs by another name, massive subsidies to their industries, and industrial policies that favor their domestic supply chains.

In brief, the effect to the United States of this unbalanced trade has been:

- Loss of >600,000 mfg. jobs from NAFTA

- Loss of 3.2 million mfg. jobs between 2000 – 2010 from China’s entry into WTO

- Loss of >60,000 mfg. jobs since Korea-U.S. agreement went into effect in 2012

- Loss of an estimated 3.4 million U. S. service and call center jobs since 2000

- Loss of an estimated 700,000 public sector jobs (2008-2013)

- Racked up cumulative trade deficit of $12 trillion in goods (average $500 billion each year) since 1994

As a result, we now have the worst trade deficit in U. S. history, and we are off to even a higher deficit this year based on the trade figures released for January ($45.9 billion) and February ($47.1 billion). As a recent example of the effect of trade agreements on our total trade deficit, our trade deficit with Korea has nearly doubled in less than four years, increasing from $14.7 billion in 2012 to $28.4 billion in 2015. Proponents of KORUS promised that it would create 70,000 jobs and $10 billion in exports.

As mentioned in a previous article, proponents of the TPP aren't even giving such rosy predictions. The Peterson Institute's analysis of the TPP states: "…GDP is projected to fall slightly (-0.54%), employment to decline by 448,000 jobs…"

Buy American Act would essentially be made null and void: The worst effect would be to those businesses who sell to the government, whether it be local, state or federal because under the TPP procurement chapter, the U.S. would have to agree to waive Buy America procurement policies for all companies operating in TPP countries. This means that all companies operating in any country signing the agreement would be provided access equal to domestic firms to bid on government procurement contracts at the local, state and federal level. There are many companies that survived the recession and continue in business today because of the Buy American provisions for government procurement, especially defense and military. The TPP could be a deathblow for companies that rely on defense and military contracts. However, it would also affect procurement for infrastructure projects, such as bridges and freeways, as well as construction of local, state or federal facilities.

Of course, this means that U.S. companies could bid on government procurement projects in TPP countries, but the trading benefit is miniscule. The U.S. government procurement market is 7X the size of current TPP partner countries (+550 billion vs. $55 -70 billion.) It is also highly unlikely that U.S. companies would be the low bidder against domestic companies in these TPP countries because of the vast difference in wages in countries such as Vietnam, where the average wage is 55 cents/hour. Past trade agreements has resulted in an average annual wage loss of 5.5% for full-time workers without college degrees, and U.S. wages have been stagnant for decades, growing by only about 2% per year since 2008. The result has been increased wage inequality from low to high wage earners.

Product labeling could be made illegal: If you like to know if your food is safe, then you won't like the fact that "Country of Origin," "Non-GMO," or "Organic" labeling could be viewed as a “barrier to trade” and thus be deemed illegal. According to Food & Water Watch, around 90% of the shrimp and catfish that Americans eat is imported. They warn, "The TPP will increase imports of potentially unsafe and minimally inspected fish and seafood products, exposing consumers to more and more dangerous seafood." Many TPP countries are farm-raising seafood in polluted water using chemicals and antibiotics prohibited in the U. S. Farmed seafood from Malaysia, Vietnam, and China is being raised in water quality equivalent to U. S. sewers. Today, the FDA only inspects 2% of seafood, fruits and vegetables, and the USDA only inspects 4-5% of meat and poultry. Increased imports of food from TPP trading partners could swamp FDA and USDA inspections, so that even less is inspected.

TPP would increase immigration: If you are concerned about jobs for yourself or family members, then you won't like the fact that the TPP increases “the number of L1 visas and the number of tourist visas, which can be used for business purposes.” Any service provider (phone service, security, engineers, lawyers, architects or any company providing a service) can enter into a TPP partner country and provide that service. Companies don’t have to hire Americans or pay American wages – they can bring in their own workers and pay less than the American minimum wage.

TPP would increase job losses in key industries: If you work in the automotive or textile industries, you may lose your job. The Center for Automotive Research projects a loss of 91,500 U.S. auto jobs to Japan with the reduction of 225,000 automobiles produced in the U.S. Also, the National Council of Textile Industries projects a loss of 522,000 jobs in the U. S. textile and related sectors to Vietnam.

TPP would reduce reshoring: Because TPP will reduce tariffs in trading partner countries, such as Vietnam, it will make the Total Cost of Ownership analysis to return manufacturing to America more difficult to justify. The high U.S. dollar has already diminished reshoring in the past year. Harry Moser, founder and president of the Reshoring Initiative, recently told me, "The combination of the high USD and TPP will reduce the rate of reshoring by an estimated 20 – 50%."

Remember that the TPP is missing any provisions to address the mercantilist policies practiced by our trading partners: currency manipulation, value added taxes that are both a hidden tariff and a hidden export subsidy, government subsidies/state owned enterprises, and "product dumping."

America is at a crossroads. We can either continue down the path of increasing trade deficits and increasing national debt by allowing anything mined, manufactured, grown or serviced to be outsourced to countries with predatory trade policies. Or, we can forge a new path by developing and implementing a national strategy to win the international competition for good jobs, sustained economic growth and strong domestic supply chains. If you support the latter path, then add your voice to mine and millions of others in urging Congress not to approve the TPP in either the regular session before the Presidential election or the "lame duck" session after the election.

About the Author

Michele Nash-Hoff

President

Michele Nash-Hoff has been in and out of San Diego’s high-tech manufacturing industry since starting as an engineering secretary at age 18. Her career includes being part of the founding team of two startup companies. She took a hiatus from working full-time to attend college and graduated from San Diego State University in 1982 with a bachelor’s degree in French and Spanish.

After graduating, she became vice president of a sales agency covering 11 of the western states. In 1985, Michele left the company to form her own sales agency, ElectroFab Sales, to work with companies to help them select the right manufacturing processes for their new and existing products.

Michele is the author of four books, For Profit Business Incubators, published in 1998 by the National Business Incubation Association, two editions of Can American Manufacturing be Saved? Why we should and how we can (2009 and 2012), and Rebuild Manufacturing – the key to American Prosperity (2017).

Michele has been president of the San Diego Electronics Network, the San Diego Chapter of the Electronics Representatives Association, and The High Technology Foundation, as well as several professional and non-profit organizations. She is an active member of the Soroptimist International of San Diego club.

Michele is currently a director on the board of the San Diego Inventors Forum. She is also Chair of the California chapter of the Coalition for a Prosperous America and a mentor for CONNECT’s Springboard program for startup companies.

She has a certificate in Total Quality Management and is a 1994 graduate of San Diego’s leadership program (LEAD San Diego.) She earned a Certificate in Lean Six Sigma in 2014.

Michele is married to Michael Hoff and has raised two sons and two daughters. She enjoys spending time with her two grandsons and eight granddaughters. Her favorite leisure activities are hiking in the mountains, swimming, gardening, reading and taking tap dance lessons.