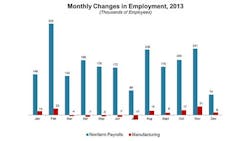

U.S. manufacturing businesses added 9,000 net new employees in December and 77,000 for the 2013 calendar year, according to the Labor Department's monthly jobs report released this morning. Industry analysts' opinions of the year-end results ranged from "relatively good" to "weak."

While the net gain of 9,000 jobs in December was down considerably from the corresponding figures for November (+31,000) and October (+17,000), it was "suprisingly good considering the much worse than expected improvement in overall nonfarm jobs," notes Alan Tonelson, research fellow at the U.S. Business and Industry Council.

Tonelson adds, however, that the big picture for manufacturing employment "remains humdrum."

"Manufacturing actually outperformed the overall economy as a job creator in December, but has still been a major employment laggard since the recovery began, and the jobs recession in the huge nondurables sector drags on," he says.

Tonelson adds that "History clearly teaches that a fast-track bill greasing the skids for more deficit-boosting trade agreements will hit manufacturing workers and their employers hardest."

Five-Month Mini-Surge

While the December data show continued weakness in the overall labor market, the manufacturing sector has experienced a notable surge in the last five months, notes Chad Moutray, chief economist with the National Association of Manufacturers. But he tempers that piece of good news with the reality that overall, 2013 "was the weakest year of hiring growth in the sector since 2009."

To counter that trend, Moutray urges federal policymakers to adopt pro-growth measures that will enable the manufacturers to expand and hire more workers.

Scott Paul, president of the Alliance for American Manufacturing, says the December numbers for manufacturing jobs are "weak" and that "talk of a manufacturing resurgence is very premature."

Paul says the last two years were "very weak for manufacturing employment" and 2014 will produce more of the same "unless Congress and the administration get their collective acts together."

"Now that the Federal Reserve has signaled a tapering of its monetary stimulus, a jobs plan must be priority number one," Paul says. "That means public investment in infrastructure, research, and worker training, a focus on cutting the trade deficit by passing currency reform legislation, and enacting a manufacturing plan along the lines of what Senate Democrats have proposed."

Sectoral Breakdown

According to the Bureau of Labor Statistics' monthly jobs report released this morning, the U.S. manfacturing sectors that posted the biggest net job gains in December were food, fabricated metal, transportation equipment, primary metals, and petroleum and coal products.

And the sectors that reported the biggest net losses were electronic instruments, computer and electronic products, printing, chemicals, and miscellaneous nondurable goods.

Manufacturing Employees by Sector

(Thousands of Jobs)

|

Sector |

Nov. 2013 |

Dec. 2013 |

Net Change |

|

Food |

1,475.5 |

1,480.8 |

+5.3 |

|

Fabricated metal products |

1,451.5 |

1,456.5 |

+5.0 |

|

Transportation equipment |

1,502.8 |

1,506.6 |

+3.8 |

|

Primary metals |

394.8 |

398.3 |

+3.5 |

|

Petroleum and coal products |

115.5 |

117.1 |

+1.6 |

|

Plastics and rubber products |

658.3 |

659.9 |

+1.6 |

|

Semiconductors and electronic components |

379.6 |

381.0 |

+1.4 |

|

Motor vehicles and parts |

824.8 |

825.8 |

+1.0 |

|

Textile mills |

114.5 |

115.5 |

+1.0 |

|

Machinery |

1,106.6 |

1,106.9 |

+0.3 |

|

Computer and peripheral equipment |

164.7 |

165.0 |

+0.3 |

|

Paper and paper products |

374.8 |

375.1 |

+0.3 |

|

Electrical equipment and appliances |

365.1 |

365.3 |

+0.2 |

|

Wood products |

353.1 |

353.0 |

-0.1 |

|

Communications equipment |

104.1 |

104.0 |

-0.1 |

|

Apparel |

140.3 |

139.9 |

-0.4 |

|

Miscellaneous durable goods |

577.6 |

576.9 |

-0.7 |

|

Textile product mills |

113.4 |

112.4 |

-1.0 |

|

Furniture and related products |

358.3 |

357.1 |

-1.2 |

|

Nonmetallic mineral products |

373.6 |

372.1 |

-1.5 |

|

Miscellaneous nondurable goods |

224.3 |

222.8 |

-1.5 |

|

Chemicals |

795.1 |

793.3 |

-1.8 |

|

Printing and related support activities |

443.3 |

441.1 |

-2.2 |

|

Computer and electronic products |

1,080.1 |

1,077.7 |

-2.4 |

|

Electronic instruments |

393.8 |

390.3 |

-3.5 |

About the Author

Pete Fehrenbach

Pete Fehrenbach, Associate Editor

Focus: Workforce | Chemical & Energy Industries | IW Manufacturing Hall of Fame

Follow Pete on Twitter: @PFehrenbachIW

Associate editor Pete Fehrenbach covers strategies and best practices in manufacturing workforce, delivering information about compensation strategies, education and training, employee engagement and retention, and teamwork. He writes a blog about workforce issue called Team Play.

Pete also provides news and analysis about successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

In addition, Pete coordinates the IndustryWeek Manufacturing Hall of Fame, IW’s annual tribute to the most influential executives and thought leaders in U.S. manufacturing history.