Improving Returns in Capital-Intensive Industries

Capital-intensive industries exist in a world of painfully low margins. Pressure to produce profits is typically so intense that many management teams struggle just to keep return on capital employed (ROCE) above the cost of capital.

The best-performing companies, however, achieve much healthier margins by focusing on the most profitable sectors; improving their cost base and capex efficiency; and taking a more strategic approach to acquisitions.

A Bain study of 30 companies across five industries — paper, steel, cement, aluminum and tires — shows that most companies deliver similarly low returns. The distribution of ROCE for capital-intensive industries over the past 25 years centers on a median value of only 5.4%, according to the study.

The median value for return on capital employed (ROCE) in capital-intensive industries is only 5.4%

The root cause of low returns is the superabundance of global capital, which fuels excess supply in industries such as cement, steel and paper. A chronic supply–demand imbalance, in turn, has forced prices down and depressed profits. Yet capital to finance capex-intensive industries remains widely available — a paradox given their low ROCE.

New players also benefit from the wide availability of new technologies that have eroded proprietary industrial processes. Global equipment suppliers and experienced managers rapidly transfer expertise to smaller challengers, helping them narrow the gap in cost and efficiency with established players.

Several guidelines can help management teams improve returns in this changed landscape.

Where to Play: A More Profit-Focused Portfolio

Many leadership teams are choosing to exit some sectors they once considered core. As they rebalance their portfolios, companies are migrating up the value-added chain, investing in related sectors where new technologies provide a competitive advantage. German steelmaker ThyssenKrupp sold its loss-making American steel finishing plant in 2013 for $1.55 billion in a restructuring shift away from the volatile steel business into higher-margin products and services, such as elevators, factory components, auto parts and marine services.

Identifying where the lion’s share of the profits come from in any sector — profit pool mapping — is an important tool for assessing where it makes sense to do business. In heavy industries, management teams often are so focused on volumes and tonnage that they overlook where the biggest profit pools are. By understanding the sources and distribution of profits across their industry, companies gain an inside edge on improving returns.

The premium end of the business typically represents a very large proportion of the profit pool. The best opportunities often cluster there for companies competing in capital-intensive industries. German tire maker Continental, for example, builds premium products that help it capture three times more economic profit than global scale leader Bridgestone.

Picking the right place to play in the value chain is also critical to improving returns — and the most profitable spot varies across industries. In seamless tube manufacturing, the process to produce premium fittings, a downstream activity — assures perfect sealing after seamless tubes are assembled, driving much higher returns than the upstream activities of tube manufacturing. As a result, a small part of the downstream business makes most of the margin.

How to Win: Four Strategic Steps to Improving Returns

Improve the Cost Base and Review Capex Continually

In capital-intensive industries where low returns have become endemic, reducing costs and improving capex efficiency are important ways to improve performance. Indeed, capital allocation is just as critical as cost — a fact that many companies overlook.

New developing market entrants in capital-intensive industries have built a strong competitive advantage by keeping capex relatively low. By contrast, the focus on cutting costs at many established players means they sometimes lose sight of improving capex. One way to get the balance right: Develop a more disciplined approach and benchmark the company’s performance against the industry’s leaders.

Build the Lowest-Cost Position

Investing in geographies that offer the lowest landed cost position can create a strong competitive advantage. It’s particularly important in asset-heavy industries where the one-time cost of closing and moving businesses is high.

The best-performing firms revisit their geographic footprint regularly, as cost dynamics are constantly evolving. A global diversified specialty chemicals company based in the U.S. decided to trim its geographic footprint, reducing the total number of plant locations by 32%. The shift improved the company’s ROCE in two ways: It reduced the capital tied up in property, plant and equipment by 5%, and it increased its profit margin.

Use Mergers and Acquisitions Strategically

Smart acquisitions can help improve performance significantly, but many companies get off to a bad start by investing at the top of the cycle, when prices are at their peak, simply because that’s when cash is available. Leadership teams that take a strategic, disciplined and long-term approach to M&A instead of a tactical and episodic approach can improve returns significantly.

Companies that nurture M&A as a core competence derive the greatest value from them. Their leadership teams devote time to developing a structured roadmap of the most attractive potential targets, making it easier to acquire assets when the right opportunity comes along — and to target acquisitions at the bottom of the cycle.

That’s a tactic ArcelorMittal CEO Lakshmi Mittal used in building the world’s largest steel and mining company from a single mill. In an acquisition spree spanning 25 years, Mittal acquired dozens of near-bankrupt steel mills in economic downswings — even when his company was short on cash. Despite the investments required to turn around those acquisitions, the total capital invested was far lower than what would have to be invested in a greenfield plant.

The Service Ace

For capital-intensive industries, service can be a highly profitable business in its own right, generating better and faster return on investment than new production facilities, large-scale R&D programs or acquisitions.

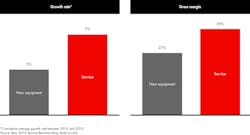

A recent Bain study across a broad cross section of industrial companies showed that service contributed 22% of total revenues and had an average gross margin of 39% — significantly higher than margins on most manufactured products. On average, the service business of these companies grew by 9% annually between 2010 and 2014 — nearly double the rate of new equipment sales.

Investing in service can generate higher revenue growth and profit

Indeed, for many industrial manufacturers, investing in service is the only way to sustainably grow profits in a tough economic environment. Investing in a service business also lowers capital intensity. A global leader in power equipment decided to invest in service and software to offset narrowing profit margins in its core business. Over the next three years, the company’s service business grew three times faster than equipment sales. And in 2014, its gross margin in service was 42% higher than its gross margin in power equipment.

Companies in capital-intensive industries operate in a difficult environment today. But leadership teams that commit to a bold ambition have opportunities to break away from the pack and achieve double-digit returns significantly above the cost of capital.

François Rousseau is a partner with Bain & Company in the Paris office and leads the firm’s Industrial Goods & Services practice in France. Luca Caruso is a partner in the London office and leads Bain’s European Industrial Goods & Services practice.