U.S. Machine Tool Orders Improved During August

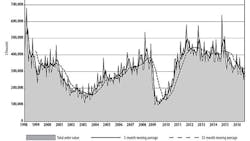

U.S. manufacturers’ new orders for machine tools totaled $336.58 million during August, rising 34.4% over the July figure and 15.9% over the August 2015 total. The report precedes by one month the anticipated boost in new orders coinciding with the International Machine Tool Show (IMTS) 2016, staged in September, and thus suggests some sustained improvement in demand for manufacturing technology.

The figures are drawn from the monthly U.S. Manufacturing Technology Orders report, compiled and presented by AMT – the Association for Manufacturing Technology. The USMTO report summarizes actual totals for machine tools, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

AMT describes USMTO data as a reliable leading economic indicator, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

Over the past two years, new orders have been inconsistent and mostly below expectations. Weak demand in the energy-related industries have been particularly problematic for manufacturing technology suppliers. In June, AMT set aside its previous forecast anticipating a Q4 2016 upswing in manufacturing demand, and later announced that current market forecasts indicate total new orders for 2016 will finish lower than 2015. AMT’s current position is that “a full-fledged market comeback (is) not expected until the second half of 2017.”

As of August, 2016 year-to-date orders were $2.43 billion, a 12.8% decline versus the January-August 2015 report.

“This was the first time since March 2015 that we saw growth in all six regions that we track for this report,” stated AMT president Douglas K. Woods. “Much of the growth came from smaller, contract machining shops, a sign of greater activity and capacity constraints in larger industries. Automotive and aerospace also made gains after some faltering. These are possible indicators that our market has hit its bottom and is signaling a comeback, albeit slowly.”

American Machinist is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)