Higher Revenue from Better Customer Experience Rather than New Products

Leading companies are evolving their approach to innovation by developing a total customer experience that combines product, service, software and hardware, according to a new survey from Accenture.

Two thirds (66%) of companies surveyed reported that their most successful innovations in the last two years have been derived from improved customer experiences and related new business models versus new products alone.

“It is no longer enough to build the next generation car, music player, crane or plane to satisfy customers. Companies need to provide a superior experience to their rivals, from the point a customer shows interest in a product, through the research and purchase, to long after they own the item, with a series of services to keep the customer delighted,” said Richard Holman, managing director, Accenture Strategy.

The survey consists of interviews with 351 G2000 companies across eight industry sectors and nine countries -- Canada, China, France, Germany, Italy Japan, South Korea, the United Kingdom and the United States.

The impact of applying innovation to all aspects of consumer interaction, rather than just a product will be significant. Accenture estimates for the automotive industry, the impact of applying innovation in this way could see revenues increase by up to $1 billion; for consumer technology the revenue impact could be $633 million; for medical technology, it could be $581 million; and for industrial equipment manufacturers, the industry impact of innovation in this area could see a revenue increase of $567 million.

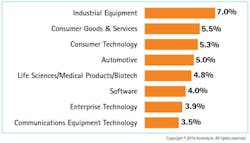

In general terms focus on distinct innovation and product development capabilities is paying off for some companies as they deliver between 3%-7% higher annualized revenue than their peers.

For example, in the communication equipment industry, the focus is on new business incubation and integration, while in the industrial equipment sector, the leaders focus on innovation and product development. For the consumer coods sector, a focus on corporate & product strategy alignment is the primary distinct innovation capability focus.

Leading companies are differentiated by “innovating in the new” versus “innovating in the core.” Traditional hardware companies are being disrupted by digital technologies and are shifting their strategies to focus on software and new connected experiences. Industries ranging from sporting apparel companies, traditional toys and games to refrigerators and other consumer durables manufacturers are now enabling consumer services through higher level of interactivity, personalization and functionality. For the leaders, differentiation comes from being able to go beyond asking customers what they want and instead targeting customers’ and consumers’ unmet needs.

Accenture has quantified the economic and financial impact of leading innovation and product development practices for the eight industries below. The research and analysis identifies the specific innovation and product development capabilities that correlate to revenue increase and operating income lift in each of the eight industries surveyed.

Based on the survey data, Accenture has segmented four distinct categories of innovators: Early Innovator, Value Maker, Market Share Protector and Efficient Executor. All of the leaders fall in either the Early Innovators or Value Makers category.

“The leading innovators, who Accenture defines as ‘Early Innovators’ and ‘Value Makers’ are focusing innovation to deliver differentiated outcomes, solutions and experiences, at a strategic level. They are seeing higher revenues as a result,” said Eric Schaeffer, senior managing director and head of Accenture’s Industrial practice.

“Only 20% of those companies surveyed fell into these two categories, with the vast majority falling into the other two categories, typified by a more tactical approach to differentiated customer experience,” said Schaeffer. ‘Value Makers’ find new ways to connect with customers through platforms and ecosystems, in which the product or service is just one dimension of a much larger value proposition.”

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek