Detroit 3 Automakers Killed Passenger Cars: Big Mistake

Imagine sitting in an automotive situation room after understanding that tariff and regulation changes have made vehicle sales growth much less certain. Everybody is nervous. A Detroit 3 boss comes in and says to all the planning types that are sitting around the conference room: “We need volume. Go out and find me a market that sells more than two million units a year. No excuses.’

Heads turn, revealing quizzical faces on the planners waiting for someone to speak. Finally, a voice from the back of the room says, “Boss, that market is right here in the United States. It’s the passenger car market and we have abandoned it.” Boss’s reply: “How did that happen”?

Let’s explore the answer to that question. The Detroit 3 used to be the preeminent players in the mainstream passenger car market in the late 70s, with GM leading the pack with Oldsmobile Cutlass and Chevrolet Impala. Yes, a nostalgic era! Those days are gone. Currently, GM has no mainstream cars, and it seems painful, and inaccurate, to say the Ford Mustang and Dodge Charger provide customers a real range of choice. But that is where those U.S. automakers are today.

Asian brands offer up a different mainstream portfolio. First off, they have 11 of the top 20 selling SUVs in the U.S. market. Toyota’s RAV4 (#1) and Honda’s CR-V (#3) are at the top of the list. Importantly, Asian companies capture nine of the top-10-selling passenger cars. Toyota and Honda have the top three passenger car models, with each selling over 200,000 per year. Are the cars expensive? No! Their hybrid models are priced as low as $24,000 and get 46 miles per gallon.

Imagine, cars and trucks living in the same showroom. To wit, there is still demand for passenger cars in the U.S. market, and those two divisions prove it.

Government Regulations: Not Car-Friendly

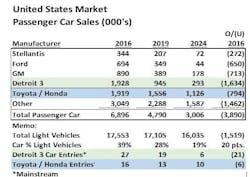

It’s no secret that the passenger car sector has lost a significant share of the market over the past eight years. Overall, passenger car sales have declined by 56% since 2016, a whopping 3.9 million units. The Detroit 3 have fared much worse, with passenger car sales declining by 84%.

Current wisdom portrays a lack of consumer interest as the primary reason for the decline in passenger car sales. That argument has merit but does not explain the total picture. A large portion of that variance can be attributed to the decline in passenger car entries at the Detroit 3, a reduction much larger than their competitors.

Toyota and Honda have only dropped six entries (mostly imported), allowing them to hold on to car market leadership. Their overall portfolio is a measure of consumers’ desire for more choice, affordability, and fuel economy. Toyota and Honda have succeeded in satisfying all three with fuel-efficient gasoline engines, hybrids, and a few electric and fuel-cell vehicles thrown in.

The Detroit 3 followed a different strategy. They were guided by government policies that helped them exit the car business and slide knee-deep into battery-electric vehicles to comply with the regulations. The 2017-25 CO2 standards for passenger cars and light trucks made it difficult to maintain small cars with gasoline engines in their portfolio. It was much easier to meet the higher standard with longer and wider cars to reduce the potential for non-compliance penalties or the need to purchase credits.

The ultimate penalty was the release of the very stringent 2026-30 CO2 standards. For example, the 2030 standards decreased the requirements to 91 grams of C02/mile for passenger cars and 110 grams/mile for light trucks, a reduction from 2024 standards by 39% and 49%, respectively. This set the stage for more non-compliance penalties moving forward.

Decision time: if you don’t have passenger cars, you don’t have passenger-car penalties for non-compliance, especially if those costs continue to chip away at car margins. Seems like bean counter-rather than consumer focused logic. The lower CO2 standard ultimately resulted in the elimination of Chevy’s Sonic, Spark, Cruise and Malibu, Ford’s Fiesta, Focus and Fusion and the Dodge Dart. Light trucks, with higher profit margins, were spared.

The Inflation Reduction Act also had an influence on the Detroit 3’s portfolio. The law made it very easy for manufacturers to get overextended on battery-electric vehicles on the taxpayer’s dime. Their first moves were to electrify trucks and SUVs and avoid a mainstream electric car entry. This was a missed strategic opportunity. Perhaps the planners did not explain that Tesla was already selling a Model 3 passenger car at a clip of 175,000 units a year.

The passing of Section 177 of the Clean Air Act did not help either. The act allows states to adopt California’s stricter vehicle emission standards. Twelve states formally adopted California’s Advanced Clean Cars II regulation. This likely led to a decision to declutter a vehicle portfolio that would need to be managed as if the United States were no longer united. Production schedules and inventory management complexity would be substantial. Passenger cars ended up on the chopping block.

Objectively, maybe the Detroit 3 cannot make cars profitably in the United States no matter the regulatory environment. This would not bode well for competing with the Chinese in the global export market. Maybe Chevrolet, Ford and Dodge are just truck divisions that will exit the global stage and hold on for dear life. Perhaps the UAW does not care, as long as the government protects them.

Detroit 3: 20/20 Hindsight

Looking backward, it is easy to see how good intentions about improving the environment became an unrealistic burden on the Detroit 3, for both cars and trucks (Note: At various stages of regulation development the Detroit 3 supported all the regulations previously discussed). The current administration and Republican-controlled Congress are looking to relieve that burden, though not all their initiatives will help in that arena (see second bullet below). Times they are a-changin'!

- The California exemption, allowing stricter CO2 standards, has been eliminated by President Donald Trump pending further litigation. A return to federal-only regulations helps Ford and GM reduce manufacturing and inventory complexity.

- Elimination of the Inflation Reduction Act has been approved by the House and is awaiting approval in the Senate. Overall, this hurts the Detroit 3, and all U.S. battery-electric development. Keeping the investment credits would help immensely.

- Unfortunately, EPA’s CO2 regulations are not likely to be modified to be less stringent (WP Browne Consulting previously proposed a five-year delay). An easing of the standard would significantly reduce payment penalties or the need to purchase credits. It would also reduce complexity and be a potential catalyst to reinstate passenger cars into the portfolio of the Detroit 3. A boost to consumers’ affordability and choice would be the result. (Note: As of June 20, the Senate parliamentarian has ruled that the emissions changes cannot be included in the One Big Beautiful Bill Act. The Senate would have to overrule the decision, and that is problematic. Changes to both the IRA and CO2 standards must happen within the same year. Otherwise, the disruption to investment could be significant). We'll see.

The changes outlined above could collectively alter the strategic direction of the Detroit 3, and put more money in their pockets, assuming that the changes are approved and last. Ford, GM, and Stellantis will need that money to pay for continued BEV and hybrid development that is not paid for by taxpayers, move some vehicle production back to the United States and fund more innovation to keep them from falling farther behind China’s vehicle development. They also have an opportunity to reach more U.S. consumers and consumers beyond U.S. borders (Mexican sales were 42% passenger cars in 2024). Collectively, they could gain plus volume from their competitors in multiple markets. Thinking outside the box is required.

Asian manufacturers have a plan to continue with cars in their portfolio—gasoline, hybrid and electric. It is time for the Detroit 3 to leverage the policy changes that are coming and alter their truck-only strategy.

About the Author

Warren Browne

President, RFQ Insights

Warren Browne, president of RFQ Insights, has held senior executive positions at General Motors Corp, working in six countries over a 40-year career with the automaker. He is currently an adjunct professor of trade and economics at Lawrence Technological University.