IW 50 Profile: PolyOne Takes Four Steps Forward

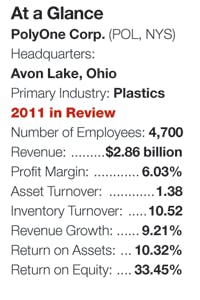

PolyOne Corp. (IW 50/28) fought back from the Great Recession with a powerful mixture of lean manufacturing, innovation and specialized product offerings.

Since launching a restructuring program in 2009, revenues for the polymer compounds manufacturer have rebounded nearly 40% to $2.9 billion, surpassing pre-recession highs. The company, based outside Cleveland in Avon Lake, Ohio, also has realized a steady increase in earnings since posting a $273 million loss in 2008. Year-over-year net income rose 6.2% in 2011 to $172.6 million.

See Also: IndustryWeek’s 50 Best U.S. Manufacturers

In July, the company reported second-quarter net income fell 14% to $24.6 million due to various one-time expenses.

PolyOne CEO Stephen Newlin credits the company's "four-pillar" strategy of "specialization, globalization, commercial excellence and operational excellence" as the driving force behind its turnaround.

Operational excellence includes a Lean Six Sigma initiative the company launched in 2009 that focused on efficiency improvements. Lean Six Sigma combines continuous-improvement methodologies of lean, such as kaizen events, with Six Sigma "belt" training and certification.

The company began the initiative by training more than 600 employees in Lean Six Sigma, according to a presentation by Thomas Kedrowski, PolyOne's senior vice president of supply chain and operations.

By 2011, 40% of the company's staff was trained in Lean Six Sigma. The project initially focused on inventory management and working capital improvements, PolyOne reports.

PolyOne realized a 40% working-capital reduction in the program's first year, the company reported. During the same period, the company's on-time delivery rose 14 percentage points to 95%. In 2011, on-time delivery remained strong at 94%, Newlin said in his annual letter to shareholders.

As part of this restructuring effort, PolyOne divested its 50% interest in a chlor alkali joint venture business with Olin Corp. (IW 500/366).

Meanwhile, the company strengthened its specialty platform with the December acquisition of ColorMatrix Group Inc., a supplier of liquid colorants, additives and fluoropolymers.

PolyOne also expanded its specialty business in emerging markets such as Russia, the Middle East and Brazil.

The company has strengthened its R&D resources with the opening of an innovation center in Avon Lake in May 2011 and the expansion of an existing center in Shanghai, China, in June.

In July, PolyOne announced a partnership with the University of Dayton in Ohio to develop advanced materials and production parts using 3-D printing technology.

Looking ahead, innovation is expected to drive the company's "next level of success," Newlin said in the annual report. He cited the company's commercial and technological commitments in 2011 as examples.

About the Author

Jonathan Katz

Former Managing Editor

Former Managing Editor Jon Katz covered leadership and strategy, tackling subjects such as lean manufacturing leadership, strategy development and deployment, corporate culture, corporate social responsibility, and growth strategies. As well, he provided news and analysis of successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

Jon worked as an intern for IndustryWeek before serving as a reporter for The Morning Journal and then as an associate editor for Penton Media’s Supply Chain Technology News.

Jon received his bachelor’s degree in Journalism from Kent State University and is a die-hard Cleveland sports fan.