Fueling Growth: Opportunities Ahead in Energy

There is no lack of good news in the U.S. economy. Automobile and housing activity are both positive and bode well for the economy, as does the rate of rise in overall retail sales. And while you may not know it because of the "weak" employment numbers reported in the general media, jobs are being added to the U.S. economy. When you strip away the seasonal adjustment factors, the number is terrific; the economy added 732,000 jobs in May.

There are many jobs still available in manufacturing and truck driving (the latter of which pays up to $50,000 a year if you know someone who is interested). The shortage of truck drivers is beginning to drive up the cost of goods as the lack of capacity has allowed freight carriers to increase prices. Expect higher labor rates in key industries in the coming year to ignite some mild inflationary pressures. This would be a good time to take advantage of the move in freight costs and either put a surcharge on or nudge your prices upward.

Five quarters ago, we forecast that the annual year-over-year comparison for U.S. industrial production would touch down in March 2012. It is therefore doubly rewarding to note that theThe relatively low cost of crude oil futures is good news in terms of affordability for businesses and consumers. It also speaks to the reduction in demand coming out of Europe and China. Our forecast calls for a pickup in activity in both regions in 2013; readers should expect rising oil prices later this year and in 2013 as economic activity improves.

The E.U. embargo on Iranian oil also will tighten oil supplies later this year. Iran already admits to a 20% to 30% reduction in exports because of the recent embargo. We do not expect a serious oil shortage to develop, as Iran's major customers -- India, China, and Japan -- have stated they will continue to buy oil from the rogue nation. South Korea has agreed to honor the embargo and buy oil on the open market. South Korea is Iran's fourth-largest customer, and thus represents a sizeable player on the world oil market. Its global search for oil will help push prices higher, but it would be a whole lot worse if India, China and Japan also were scrambling for fresh sources of crude oil.

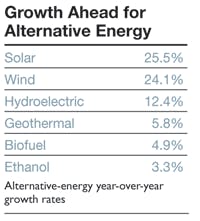

Alternative forms of energy are showing signs of lessening demand, but this should reverse direction as demand for oil and oil prices both pick up next. The annual year-over-year growth rates are shown to the left (all figures relate to current levels of U.S. consumption except for ethanol, which is a production figure). None are in danger of going below year-ago levels. IndustryWeek readers participating in this market should expect more sales opportunities through the coming four quarters barring legislative interference.

The energy industry will present businesses with good growth opportunities in the coming quarters. This is an opportune time to begin to fill your order pipeline with longer-term projects in anticipation of the late 2013/2014 downturn. 9

Contributing Editor Alan Beaulieu is an economist and president of ITR (itreconomics.com). He is co-author, with his brother Brian, of "Make Your Move," a book on spotting business-cycle trends.