Service Lifecycle Management: The Key to Unlocking Hidden Profits for Many Durable Goods OEMs

Post-sales service is one area of the supply chain where profit potential still remains untapped by many manufacturers. But that may be changing with mounting evidence of its impact on a company's bottom line.

"During the last recession, when revenue growth slowed for many companies, service revenues from the existing installed base continued to grow. Today most CXOs agree that service is critical for sustained and profitable revenue growth," says Gopalakrishnan V K (Gopal), vice president at Genpact, a global leader in business process and technology management.

A recent note from Arizona State University's Center for Services Leadership aptly states, "An excellent product no longer guarantees business success. Finding new sources of income and growth has become a matter of competitive necessity for traditionally product-oriented companies."

With investments in service process improvements gaining momentum, many manufacturers have begun to organize component service business processes under the umbrella of Service Lifecycle Management (SLM) in much the same way as they've done in areas like Supply Chain Management and Product Lifecycle Management.

SLM can be defined as the profit-driven optimization of processes across the service network to ensure durable goods perform as promised after the sale. These service processes can include call center management, warranty management, remote diagnostics, field dispatch, dynamic scheduling, service parts management, mobile communications, service parts pricing, knowledge and content management, returns management and depot repair.

If service executives continue to focus their improvement efforts only on pieces of the service network, the whole will suffer. It is important to have an actionable view of total service costs, risks to revenue targets, and threats to customer loyalty in order to maximize financial returns from post-sales service. Without this view, OEMs will incur unnecessary costs, miss revenue opportunities and risk customer attrition.A recent study from a leading industry analyst cautions against this fragmented approach: "SLM...incorporates roles and responsibilities from various groups that often have different goals and measures. Typically, these groups have acted semi-autonomously, with no management incentive, to synchronize their activities in the overall context of the business strategy. This limits the profitability of the overall service business. Leading service companies, however, bring these various roles together under one group or executive and use common technology platforms."

A service event typically involves multiple service network nodes, requiring coordination of people, parts and other resources to enable delivery of best-in-class customer service. Fractured service operations is evidenced in many organizations by a loose "baton-passing" structure. Aberdeen Group has quantified what occurs when service processes aren't integrated: "24% of dispatches require repeat visits. 42% of these repeat dispatches were due to unavailable parts, and 25% from improper diagnosis. Moreover, 25% of parts orders contain multiple parts since the technician cannot determine which one is needed."

These benchmarks show that disjointed post-sales operations abound, resulting in inefficient scenarios such as:

- Lack of visibility into prior problem resolution leading to unnecessary field service dispatches or maintenance bay service orders thus duplicating diagnostic efforts and reducing first time fix rates.

- Swapped spare parts thrown over the wall into the reverse logistics warranty or recycle loop, with little or no collaborative analysis to iteratively reduce no-fault-found rates.

- Quality engineers cannot correlate service events to measure or improve operations.

"After-sale service...operations that really add value-that enhance customer satisfaction, contribute significantly to companies' revenue and profit goals, and promote rigorous cost efficiency-are rare...The most important characteristic of a Service Value Chain is its clear integration with all functions that influence a company's ability to provide service to its customers," noted a recent study from a major management consultancy.

A large white goods retailer is one of these rare performers. The company remotely diagnoses customer service requests, which initially resulted in a four-fold improvement in its dispatch avoidance rates, equating to millions in monthly savings. Its customers are now more satisfied due to more effective call center efforts to restore appliance uptime. The retailer's success required process, financial and technology coordination between the call center and field service organizations. Handle times spiked a few percentage points but yielded more than offsetting savings downstream in field dispatch avoidance and increased customer loyalty.

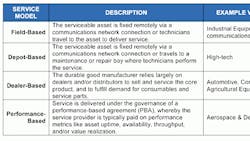

While the upside to integrating service processes is evident, significant challenges in people, process and technology management hinder many manufacturers' success. A good first step for an OEM is to determine which service execution models comprise its service value chain. Over 80% of service operations identify with having one or more of the service models described in Table 1.

The presence of these models in an OEM's service operations should help to isolate primary cost- and value-drivers, establishing a framework for prioritizing improvement tactics. To drive high asset availability, business growth and profitability, SLM should bridge gaps among such areas as field service, parts management and returns and repair.

Whether you start by integrating parts planning with field service or field service with knowledge management and remote service, investment in SLM will drive significant cost efficiencies for your service organization, trigger immediate positive impact to overall corporate profitability and position your company to more effectively compete for additional value-added services required by your customers. Establish process and technology backbones that not only coordinate your existing service models, but also set the foundation for future service models.

Mark W. Vigoroso is senior vice president, Global Marketing and Alliances, for Servigistics which is a solution provider for Service Lifecycle Management (SLM).