Late Payments Up, Orders Down: a Canary in the Supply Chain Coalmine

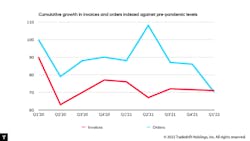

The end of 2021 offered signs of hope. According to Tradeshift’s Q4 Index of Global Trade Health, which analyzes anonymized data flowing across our platform, order volumes were up and there appeared to be a gradual easing of the bottlenecks that had left supply chains snarled.

But the world had other plans. The same report for the first quarter of 2022 shows another steep fall in activity across the world’s supply chains as Russia’s war on Ukraine added a further dimension to an already turbulent trading environment.

Businesses accustomed to extended periods of relative stability are now seeing a merging of crises. China’s zero-COVID policy, which has led to yet another round of lockdowns in major cities across the country, is also bringing a resurgence in port congestion—which is once again reaching record levels. Our own analysis of transaction volumes (orders from buyers and invoices from suppliers) showed activity in China fell by a further 3 points in Q1, the third successive quarter of lost trade momentum.

Manufacturers, particularly those in the industrial heartlands of Western Europe, have been the hardest hit by the recent turmoil. Total transaction volumes across the Eurozone fell 14 points in Q1, the steepest loss of momentum since the beginning of the pandemic. Globally, our data suggests supply chain activity related to the manufacturing sector is 25% lower than expected.

A Canary in the Coalmine

It may be months before we understand the full impact that this latest wave of disruption has on the movement of goods. Nevertheless, patterns in ordering activity among large buyers give us a strong sense of how senior business leaders see the road ahead.

Order volumes on the Tradeshift network dropped by nearly 20% at the beginning of 2020, when many businesses were predicting a long and painful recession. When consumer purchasing bounced back unexpectedly, we saw huge and unpredictable spikes in order volumes as buyers rushed to fulfill demand. Supply chains, built for stability, found the feast as hard to stomach as the famine.

The 16 point fall in orders we observed in the first three months of 2022 is alarming and indicates buyers are once again bedding in for a challenging economic period. It also suggests an end to the “demand-crunch” cycle of the past year and the return to a “supply-crunch” triggered by geopolitical tension and lingering COVID restrictions.

Late Payments Surging

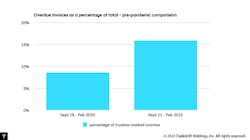

In a perfect world, buyers and suppliers would be working together to address these challenges. Unfortunately, our data suggests the opposite is occurring: Late payments to suppliers are trending at almost double the rate we saw in the six months prior to the pandemic. In business, as in many aspects of life, cash remains king. So when volatility emerges, the first reaction among many large buyers is to keep hold of it for as long as possible.

As enterprises look to access the cash flow needed to ride out another difficult period, CFOs are being asked to look at all levers they can pull to do this, including delaying payments to suppliers. This kind of narrow thinking is likely to harm them in the future as cash-flow pressure takes its toll on their supply lines.

The End of Globalization?

Tumbling orders and surging late payments have been constant and recurring themes throughout the pandemic. To the casual observer, this latest chapter in our age of uncertainty may feel like “deja vu all over again.” But fundamental changes are already beginning to take root that will reshape global supply chains for decades to come.

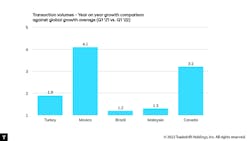

Commentators including Blackrock CEO Larry Fink have gone so far as to predict the end of globalization, believing that the war in Ukraine will prompt companies to pull back from their global supply chains altogether. Meanwhile, research by Goldman Sachs suggests U.S. companies are ploughing ahead with efforts to diversify supply chains with a particular focus on moving manufacturing imports away from China.

Interestingly, our own data suggests countries bordering the U.S., including Mexico and Canada, are already benefiting from a push towards nearshoring. Invoice traffic from Mexican suppliers rose at 4.1 times the global average over the past year, while Canadian supplier invoices climbed 3.1 times more than the average.

Networked Supply Chains

Reconfiguration of the kind we are now seeing accelerate is both complex and costly, requiring sustained and coordinated investment from governments and business. Supply chains will need to evolve from single-node, linear relationships, to multi-node networks with redundancies built in. To achieve this, buyers will need to identify, vet and onboard an entire ecosystem of new suppliers.

Some analysts believe cloud-based B2B marketplaces that connect multiple buyers with multiple suppliers will be key for large organizations to build resilience and agility, offering increased access to suppliers and greater visibility all the way down the supply chain.

Supply chain disruptions are no longer one-offs. Following old procurement models and chasing short-term gains at the expense of healthy supplier relationships is the fast track to a dead end. As buyers look to move away from single-sourcing models, leaders must be more cognizant of the impact their actions will have on their supplier partners.

The case for a dynamically connected ecosystem of buyers and suppliers is also becoming increasingly undeniable. Globalization may be in decline, but resilience will depend on supply chains becoming more more collaborative, more diverse and more connected.

Christian Lanng is co-Founder and CEO at Tradeshift, the largest business commerce company in the world, which provides a global commerce platform connecting buyers and sellers.