IndustryWeek’s 2025 Salary Survey: Wages Recover Following Turbulent Year for Manufacturing

Key Highlights

- The overall average of manufacturing salaries increased by 13.1% in 2025.

- Supply chain and operations leaders experienced a significant salary boost, possibly reflecting their rising strategic value amid tariff uncertainties and technological advancements.

- Employee satisfaction slightly declined, with 67.9% of respondents reporting they are "satisfied" or "very satisfied" with their jobs.

- Labor shortages remain a major challenge. Nearly 75% of company locations have struggled to fill a position in the last year due to a lack of skilled candidates.

Salaries have bounced back in a major way after wages took a tumble in 2024. Most notably, supply chain/logistics workers saw a massive 37.9% jump in wages. Results from our 2025 IndustryWeek Salary Survey of manufacturing management revealed a shrinking gender wage gap, though substantial disparities between men and women in the industry persist. Also, the unhappiest employees continue to earn the highest salaries.

The average salary reported by our readers in the salary survey hit $135,525. That is 13.1% higher than the 2024 figure of $119,785 and 1.1% higher than the average of $133,997 in 2023.

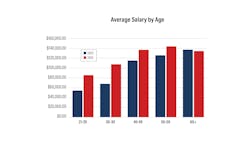

Last year’s results likely reflected an increase in younger manufacturing workers as opposed to salary cuts for experienced employees, but data from this year showed dramatic wage increases across every age group besides 60-plus.

We received about the same number of viable responses—374—in 2025 as we did in 2024.

Thank you to everyone who participated in this year’s survey. Before we dive deeper into the data, here’s a quick breakdown of our respondents’ responsibilities:

- Corporate/administration: 19%

- Engineering/technology: 27.5%

- Operations/plant operations: 36.6%

- Sales/marketing: 8.6%

- Supply chain/logistics: 8%

Salaries Rebound

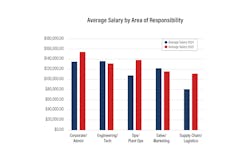

Salaries shot up for many of the top leadership roles, while engineering salaries showed less momentum. Supply chain and operations leaders received what some might say is overdue recognition for their value, as their specialized skills were in demand with tariff uncertainty and the fast pace of technology adoption.

Corporate/administration: These roles reclaimed the top spot, reporting the highest average salary at $154,711, 13.8% higher than 2024’s figure.

Operations/plant operations: Although last year these jobs were the second lowest-paid, they catapulted to second highest this year, with an average salary of $138,834.

Engineering/technology: After reporting the highest salaries in our 2024 survey at $136,603, these roles fell to third place this year, with respondents making a slightly lower average salary of $131,914 in 2025.

Sales/marketing: These employees saw a slight decrease in salaries compared to 2024’s $122,498, reporting an average 2025 salary of $116,155.

Supply chain/logistics: Despite this category landing the lowest average salary by area of responsibility, pay rose 37.9% to $111,645, up from 2024’s $80,971.

Nearly two-thirds (64.4%) of our respondents reported a salary increase of at least 1% in the past year. Only 4.8% reported a salary decrease, and 30% reported no change in salary. These figures are similar to last year’s survey, indicating salaries are generally on the rise.

Salaries increased for almost every age group, leaving the 60-plus group of employees at just slightly below last year’s level. Interestingly, the 50-59 age group reported 7.1% higher average salaries than the 60-plus group.

In addition, the average salary for the youngest workers proves that manufacturing jobs can earn workers a living wage even at the beginning of their careers.

- 21-29 – $85,250

- 30-39 – $107,276

- 40-49 – $136,646

- 50-59 – $143,767

- 60-plus – $134,186

The gender wage gap continues to shrink, although considerable disparities remain in pay and representation. Men made up over three quarters (75.4%) of our survey respondents—up from 72% of respondents in 2024—and made an average of $140,342.

Women had an average salary of $115,971, or 17.4% less than the average man. Although this is a remarkable 50.4% less than the $49,144 wage gap recorded in our 2024 survey, the number leaves much to be desired.

A female respondent working in operations/plant operations wrote, “As a woman I am certain that I earn less than my male counterparts.” This observation aligns with our data, which shows that women within that area of responsibility make an average of $106,314 while men make $149,349, a 40.5% higher wage.

Employee Satisfaction

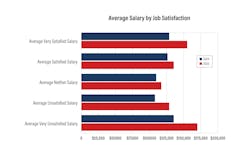

Despite lower levels of job satisfaction compared to 2024, employee attitudes toward their current jobs are solid. Two-thirds (67.9%) of our respondents report they are “satisfied” or “very satisfied” with their jobs, slightly lower last year’s figure of 74%.

Interestingly, the unhappiest workers were the highest paid. Perhaps they miss some of the hands-on challenges of their earlier roles or are caught in the “golden handcuffs” of top pay but less job satisfaction

The following shows the overall percentage of how satisfied our respondents are with their current job:

- Very satisfied: 28.6%

- Satisfied: 39.3%

- Neither satisfied nor unsatisfied: 17.4%

- Unsatisfied: 9.6%

- Very unsatisfied: 3.7%

Our data on average salaries by job satisfaction creates a parabolic graph, with the highest salaries being on the “very satisfied” ($151,341) and “very unsatisfied” ($165,855) responses, and the lowest being right in the middle with the “neither satisfied nor unsatisfied” ($114,315) response.

- Very satisfied: $151,341

- Satisfied: $132,228

- Neither satisfied nor unsatisfied: $114,315

- Unsatisfied: $125,581

- Very unsatisfied: $165,855

When asked what matters the most to our respondents about their job, “base salary” (20.9%), “challenging work” (18.4%) and “job stability” (12.8%) came out on top.

Business Challenges

Labor Unrest

A lack of skilled workers presented a major issue for manufacturers, with nearly 75% of respondents saying their company location had struggled to fill a position due to a lack of skilled candidates in the last year. This percentage was up slightly from 2024 (71%).

According to one respondent in human resources management, changing expectations from employees is a driving factor behind hiring issues.

“There has been a shift in what is important to employees, and base salary alone will not retain,” the respondent wrote. “Not only do we need to pay a truly ‘living wage’ and provide ample paid time off, but we also need to provide work/life balance while satisfying production goals, recognize employees for the work they do and invest time to improve and/or develop employees. Sounds simple—but for whatever reason, many in production management find it difficult to do these things.”

When asked what their companies are doing to attract and retain talent, a few respondents mentioned the addition of maternal/paternal leave and flexible scheduling. Other efforts noted: mentoring programs, employee appreciation events and education incentives. Some of our respondents reported that a lack of loyalty programs for existing employees, such as profit sharing and pensions, is causing a dip in morale.

Geographic Region

By geographic region, New England (CT, MA, ME, NH, RI, VT) had the highest average salary by far at $173,950. In second place is Pacific (AK, CA, HI, OR, WA) with an average salary of $148,146.

Mountain (AZ, CO, ID, MT, NM, NV, UT, WY) had the lowest reported average salary ($123,505). The biggest segment we received responses from was North Central (IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, SD, WI), which accounted for 35.6% of our respondents; the average salary for that region is $124,487.

Stagnant hiring and headcount reductions have taken their toll, said a respondent in the plastics and rubber products industry.

“My challenge is that the company keeps requiring me and my team to do more and more and more, with the same number of people, the same resources, and at the same salary level,” the respondent said. “We can only ‘expand’ so much until we start to break / burn out.”

The biggest challenges, wrote another HR management respondent, are “company, political and economic-climate challenges. Employees want more pay, tariffs are heavily impacting costs, the squeeze makes it impossible to navigate, and people are the largest asset and expense.”

Tariffs Cause Widespread Chaos

Predictably, concerns surrounding tariffs are another dominant theme in this year’s survey, with three-quarters of respondents saying that tariffs are impacting their business. Comments emphasize tariff complexity and challenges, including increased raw material pricing, difficulty with constantly fluctuating policies and delays in investments and hiring—all of which are making it difficult for companies to find footing.

“If things do not change, we will not survive,” wrote one respondent in the additive manufacturing industry. “The tariffs on top of the uncertainty caused by the new administration is causing a kind of paralysis.”

Sustainability’s Significance

Nearly three quarters (74.1%) of respondents say sustainability is either “important” or “very important” for their company. Some see more room for sustainability efforts, with one corporate/executive management respondent noting they are “waiting for government and industry to get serious about wanting to reduce waste and increase energy efficiency.”

Tech Anxiety

Introducing and integrating new technologies into the production workflow was on the minds of our respondents.

Bonuses

Over half (54.3%) of our respondents reported receiving an annual bonus. The average bonus is $37,256. The following breaks down the average bonus by area of responsibility:

- Corporate/administration: $49,374

- Engineering/technology: $19,573

- Operations/plant operations: $49,393

- Sales/marketing: $35,669

- Supply chain/logistics: $12,561

“One of the biggest challenges … is adapting to rapid technological change while maintaining operational efficiency,” wrote one respondent in the automotive sector. “We're seeing a push toward automation, AI and smart factory systems, but integrating these technologies into legacy processes isn't always straightforward, especially for companies that have been doing things a certain way for decades.”

DEI Shifts

Following years of debate around diversity, equity and inclusion efforts, and the Trump administration’s recent push to dismantle them, we asked our audience about the state of DEI at their own companies.

When asked if their company’s DEI policy had changed in the past year, our survey found the following:

- No. We have kept our DEI program in place: 39.6%

- No. We have no DEI program: 46.8%

- Yes. We established a DEI program: 5.9%

- Yes. We have eliminated our DEI program: 6.4%

Looking Ahead

While manufacturers are making investments in technology, industrial education programs are falling short, said some respondents.

“Our educational infrastructure is not adequate to support technical, trade and hands-on learning! Too many budget cutbacks of teaching basic trades: mechanics, pneumatics, electronics, how and why things work, hydraulics, quality systems, design principles,” wrote one respondent working in quality management.

The same respondent shared a motivational message.

“Manufacturing - and industry in general is fascinating, rewarding and very challenging - all at the same time! We need to do a much better job of getting the next two generations excited.”

About the Author

Anna Smith

News Editor

News Editor

LinkedIn: https://www.linkedin.com/in/anna-m-smith/

Bio: Anna Smith joined IndustryWeek in 2021. She handles IW’s daily newsletters and breaking news of interest to the manufacturing industry. Anna was previously an editorial assistant at New Equipment Digest, Material Handling & Logistics and other publications.