Inflation: Is the Worst Over?

As the world swelters in record temperatures from the U.S. to China, sizzled citizens can at least look forward to summer’s inevitable end and the arrival of misty, fruitful autumn. For the global economy, sadly, no such relief is in sight.

At the beginning of the year, there were reasons for tentative optimism as the supply chain bottlenecks of the previous 18 months started to ease. Then Russia decided to invade Ukraine and all hell broke loose. Back in April, Tradeshift’s quarterly Index of Global Trade Health recorded the biggest fall in transaction volumes across the Eurozone since the beginning of the pandemic, while global manufacturing activity was 25% lower than expected.

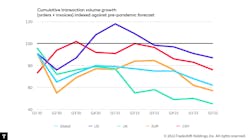

Three months on, there is mounting evidence that the world economy is slipping into recession. Order volumes in Tradeshift’s platform fell for the second consecutive quarter, sliding a further six points against the expected range.

This lack of fresh orders is beginning to impact suppliers. Invoice traffic on the Tradeshift platform fell by 7 points in Q2, the steepest drop in a year and the first time since lockdown that we have seen a fall of this magnitude across both orders and invoices in the same quarter.

Q2 Delivers a Global Warning

What’s striking about this quarter’s index is the near-uniform pattern of plunging transaction volumes across most of the world’s largest economies. Supply-chain activity in the Eurozone and the U.S. fell for the second quarter in a row, dropping by 5 and 4 points respectively, while activity in the U.K. also slid a further five points against the forecast range.

This global warning is in danger of being obscured by an even bigger economic story: inflation. Orders might be softening, but Tradeshift’s analysis suggests costs have risen sharply since the beginning of the year. The average value of an invoice submitted on Tradeshift’s platform has increased by 11% since the start of 2022, compared to a more modest 3.5% rise in 2021.

Inflation has many causes, many of them obvious to the untutored eye. Supply-chain disruptions have persisted across the global economy. COVID-19 cases in China and the imposition of lockdown restrictions continue to cause problems. Our data shows that supply chain activity across the region sank a further 7 points below the expected range in Q2. Russia’s invasion of Ukraine is adding further pressure, especially to energy and food prices.

A Farewell to Cheap Labor

Some of the current challenges facing supply chains are transitory. A report by Dutch Financial Services Group ING suggests U.S. inflation may already have peaked. It would be wrong, however, to ignore the structural changes in the world economy that could mean inflation remains a recurring problem.

The link between labor shortages and wage inflation is a good example. We’re reaching the end of the golden period of cheap labor that began in the 1980s as Eastern Europe and China opened up to international markets and baby boomers pursued their careers. This labor influx kept inflation low and removed the incentive to invest in automation, with labor-intensive manual processes remaining a feature of the workplace today.

That cycle is coming to an end. The U.S. is one of a number of Western countries facing the prospect of a shrinking labor pool. In the 1990s, the working age population in the U.S. grew at roughly 1.3 million a year. In the coming year, the working age population is expected to grow by just 400,000. No wonder, then, that even as a recession seems to be on the horizon, there are still more open job roles than candidates to fill them.

Not only are there fewer workers, but those entering the workforce are also asking harder questions of the kind of work they are prepared to do.

Automation: No Longer a Luxury

Businesses are examining choke points in their supply chain and realizing that chucking more bodies at these problems is no longer an option. According to one recent study, 78% of executives are planning to invest in automation to mitigate the impact of future labor shortages.

Automation may no longer be a luxury, but neither is it a panacea. Germany’s post-war “economic miracle” was powered by adoption of technology, but it was never about replacing people with machines. It was a holistic strategy, built on ensuring a limited labor pool could focus on delivering a higher value output. Even today, Germany has more industrial robots per capita than any Western economy, but it also has among the highest proportion of young people in apprenticeships and a high per capita commitment to lifelong learning opportunities.

Long viewed primarily as a way to reduce overheads, automation is fast becoming a key component of long-term risk management and resilience planning across global supply chains.

Choppy Waters Favor Strong Sailors

Alan Jope, the Unilever CEO, is one of a growing number of senior executives who believe that we need to accept crisis as the new normal. The current bout of inflation may well ease over time. We may even avoid a long recession. But bigger issues will be waiting on the other side.

Labor shortages, geopolitical tension and the pressure to decarbonize supply chains: these are the three megatrends that will define the global business ecosystem over the next decade and more. The cost of inaction will only grow over time.

Adversity is always a good motivator for both creative thinking and collaborations of common interest. The pandemic split the business world into two camps: those that had digitized their operations and could remain agile, and those that hadn’t. That fissure will become an ever-wider chasm over the next two years. Technology gives us many of the tools we need to lessen the resurgent influence of not only inflation but other nagging supply-chain issues as well. Stand still now, and it won’t be long before you start feeling the heat.

Christian Lanng is co-founder and CEO at Tradeshift, the largest business commerce company in the world, which provides a global commerce platform connecting buyers and sellers.