Make Your Move: Finding Opportunity in the Mining and Metals Market

Headlines, commercials and political slogans make it difficult to get an accurate picture of the U.S. and global economies. Fortunately, there are reasons for optimism as we rapidly approach 2013. The recent U.S. GDP numbers are positive, and the year-over-year annual growth rate in U.S. industrial production is relatively stable at 4.1%. Consumer spending is at record-high levels and banks are willing to lend. The housing industry is in recovery, and automobile sales are posting impressive year-over-year increases. We acknowledge the concerns espoused in the general media, but we are more impressed by these and other positive facts of ongoing economic expansion.

See Also: The ITR Economics "Make Your Move" Blog

The election cycle has heightened economic uncertainties, and the result has been a dramatic reduction in capital expenditures over the last few months. This is certainly understandable in the face of the so-called 'fiscal cliff,’ possible tax increases on business, certain tax increases on individuals, and the ever-present threat of a European collapse. The good news is that we utilize a system of leading indicators, such as the Conference Board’s U.S. Leading Indicator and the Institute for Supply Management’s Purchasing Managers Index, and they are pointing toward additional economic growth in the first half of 2013.

A rise in global demand and the resolution of U.S. political challenges by early 2013 will be good news for the mining and metal industries. Uncertainty over these difficulties has taken a toll. Quarterly nondefense capital-goods new orders have quickly fallen 5.7% below the year-ago level in large part due to the desire to safeguard cash instead of purchasing new equipment. As a result, mining and metalworking machinery new orders are slowing or even faltering; production has begun to moderate; and inventory levels are rising up to 19.9% above last year. However, we are projecting that the end of the U.S. political season and the effects of stimulative monetary programs across the globe will help boost growth in early 2013. These results will encourage more investment in machinery and equipment, increase mining activity and help improve machinery production.

The metals and mining industries are feeling the pain of uncertainty and economic slowdown in Europe and Asia. World Steel Production (on an annualized basis) has slowed to a growth rate of just 1% above the same time last year. The major producers are seeing the slowdown in their steel-production rates of growth: India (6.3%), U.S. (6.2%), South Korea (5.1%), Japan (-0.7%) and Europe (-4%). However, one of the most significant drops has come in China, which stood at 9.4% annual growth last September but is now only at 1.7%.

This transition in Chinese production is part of a much wider economic slowdown in China. Industrial production for China has slowed to 10.6% above last year. While still a respectable level of growth, this moderation has had a wide impact on the mining and metalworking industries. China pig iron, copper and nonferrous metal production are experiencing slower growth. However, leading indicators are suggesting that the slowdown may be nearing an end, and a slightly higher growth rate will occur in early 2013. A recently announced stimulus plan (approximately $150 billion) will begin taking effect early in 2013 and help bolster lagging demand.

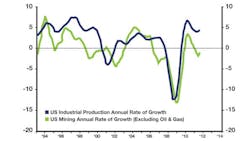

While certainly not a cure-all, renewed demand in Asia bodes well for the U.S. mining and metal production industries. Prices are showing the effects of the current slowdown; iron ore and steel prices have tumbled 43.9% and 15% below September 2011, respectively. However, the recent contraction in metal-ore mining and all U.S. mining (excluding oil and gas) ended in mid-2012, and as the chart shows, mining (green line) is beginning to recover. Renewed Asian demand in early 2013 will help push prices upward. Expect some upward pressure on metals and other commodities in 2013 as Chinese activity improves from current levels. There will be opportunities in 2013, but be careful. We expect the growth will be relatively short-lived, and demand will weaken in the second half of the year.

Contributing Editor Alan Beaulieu is an economist and president of ITR. He is co-author, with his brother Brian, of "Make Your Move," a book on spotting business-cycle trends.