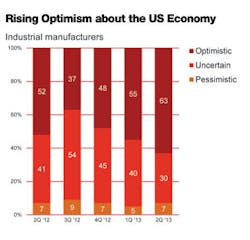

Some 63% of manufacturers said they are optimistic about the U.S. economy, up from 55% in the first quarter and 11 points higher than a year ago, according to the Q2 2013 Manufacturing Barometer from PwC US released today. Moreover, 72% of respondents said they believe the U.S. economy grew in the second quarter, up 10 points from the first quarter of 2013.

But only 31% of manufacturers said they were optimistic about the world economy, while 59% said they were uncertain. The 32 point spread in optimism between the domestic and global outlooks was the second highest quarterly total since those questions were first asked in the third quarter of 20013, PwC observed.

Noting the “persistent dichotomy” in outlooks for the U.S. and world economies, Bobby Bono, U.S. industrial manufacturing leader for PwC, said: “The U.S. is starting to show signs of healthy demand trends and improving pricing power, supporting positive overall sentiment in the year ahead. However, as a result of the mixed global outlook, combined with the moderate domestic recovery and the specter of increased legislative and regulatory pressures, management teams are continuing to carefully manage their costs, while maintaining a focus on growing profitably.”

Reflecting optimism regarding the domestic economy, 82% of manufacturers surveyed expect positive revenue growth for their own companies in the next 12 months. Only 3% are forecasting negative growth. The projected average revenue growth rate over the next 12 months was 4.6%, up from 4.3% in the first quarter, but down from 5.6% in last year’s second quarter.

With regard to capital spending, 40% of respondents plan major new investments during the next 12 months, off three points from 43% in the first quarter, but well below the 55% recorded in the second quarter of 2012. Manufacturers indicated a slight pullback on investment, to 4% as a percentage of total sales, which PwC said reflected in part a reduction in planned spending increases from the peak post-recessionary period, which benefitted from pent-up demand.

Plans for operational spending also remained notably below prior year levels. Looking at the next 12 months, 73% of respondents plan to increase operational spending, similar to 71 % in the first quarter, but down from 87% in the second quarter of last year. Leading increased expenditures were new product or service introductions (45%) and research and development (38%). Plans for geographic expansion remained low at 15%, up from 10% in the first quarter, but down significantly from 33% last year.

“We are also continuing to see little enthusiasm for overseas expansion, while management teams target spending primarily on R&D, new product launches and IT,” said Bono. “This suggests they are focusing inward on innovation and leveraging their core strengths in a competitive domestic environment.”

Manufacturers Plan Slight Boost in Hiring

The number of manufacturers planning to hire in the next 12 months dipped to 42% from 45% in the first quarter. Only 5% plan to reduce the number of fulltime equivalent employees, and 53% will stay about the same. The net workforce projection stayed at plus 0.9%, similar to last quarter’s plus 1%, indicating some new hiring continuity among several of these industrial manufacturing companies. The most sought-after employees will be production workers (23%), skilled labor (23%) and professionals/technicians (18%).

Similar to levels recorded in the first quarter, second quarter survey respondents highlighted legislative/regulatory pressures (53%) and lack of demand (47%) as the biggest barriers for growth over the next 12 months. Oil/energy prices were viewed by 22% as a barrier to growth, a significant drop from 35% in the first quarter and 48% in last year’s second quarter.

“We’re seeing a significant moderation in concerns regarding energy costs among industrial manufacturers, consistent with other recent PwC studies. It appears that the increase in shale oil and gas production domestically is having a positive effect on energy costs and is now impacting strategic planning among some industrial manufacturers. This is a welcome development for management teams given the moderately growing economy and the continued emphasis on controlling costs,” added Bono.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek