US Energy Imports to Drop While China's, India's and Europe's Rise

The U.S. economy will reap big benefits over the next six years thanks to increased domestic oil and gas production, while at the same time major supply-demand shifts will adversely affect the economies of China, India and Europe.

That's the key finding of the the U.S. Energy Information Administration's early-release 2014 Annual Energy Outlook.

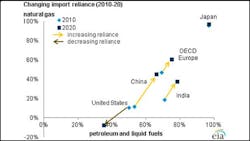

The EIA's report projects major declines in the amount of oil and natural gas imported by the U.S., due primarily to increased domestic production from tight oil and shale plays.

The percentage of liquid fuels consumed within the U.S. that are imported will drop from a high of 60% in 2005 to about 25% by 2016. Additionally, the United States is projected to become a net exporter of natural gas by 2018, according to the report.

Elsewhere, a Reliance Upsurge

Meanwhile, the economies of China, India and Europe will become increasingly reliant on imported oil and natural gas.

According to the EIA's projections, by 2020 all three of those economies will import at least 65% of the oil and 35% of the natural gas that they consume.

The reasons for these global import shifts are disparate, according to the EIA report:

- In China and India, those nation's emergent, fast-growing middle classes will pump demand for oil well beyond domestic companies' ability to keep pace with production.

- The nations of OECD Europe will have to import more because of declining oil production in the North Sea.

Read the full report at EIA.gov.

About the Author

Pete Fehrenbach

Pete Fehrenbach, Associate Editor

Focus: Workforce | Chemical & Energy Industries | IW Manufacturing Hall of Fame

Follow Pete on Twitter: @PFehrenbachIW

Associate editor Pete Fehrenbach covers strategies and best practices in manufacturing workforce, delivering information about compensation strategies, education and training, employee engagement and retention, and teamwork. He writes a blog about workforce issue called Team Play.

Pete also provides news and analysis about successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

In addition, Pete coordinates the IndustryWeek Manufacturing Hall of Fame, IW’s annual tribute to the most influential executives and thought leaders in U.S. manufacturing history.