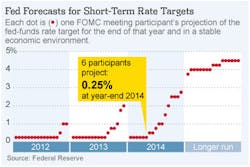

These are reasonable interest rate expectations given the anticipated inflationary pressures. It's encouraging to see that some members of the committee have a good grasp on reality.

It is always unwise to bet against the Federal Reserve Board. Expect low rates to extend through at least mid-2013, which means you don't have to run out and borrow right now to lock in low rates.

However, our economic forecast suggests that you should invest in your firm now in order to maximize your growth potential over the next 18 months and to prepare yourself for 2014.

Invest in efficiencies, training, customer satisfaction efforts, new products and new marketing efforts.

About the Author

Alan Beaulieu Blog

President

One of the country’s most informed economists, Alan Beaulieu is a principal of the ITR Economics where he serves as President. ITR predicts future economic trends with 94.7% accuracy rate and 60 years of correct calls. In his keynotes, Alan delivers clear, comprehensive action plans and tools for capitalizing on business cycle fluctuations and outperforming your competition--whether the economy is moving up, down, or in a recession.

Since 1990, he has been consulting with companies throughout the US, Europe, and Asia on how to forecast, plan, and increase their profits based on business cycle trend analysis. Alan is also the Senior Economic Advisor to NAW, Contributing Editor for INDUSTRYWEEK, and the Chief Economist for HARDI.

Alan is co-author, along with his brother Brian, of the book MAKE YOUR MOVE, and has written numerous articles on economic analysis. He makes up to 150 appearances each year, and his keynotes and seminars have helped thousands of business owners and executives capitalize on emerging trends.

Prior to joining ITR Economics, Alan was a principal in a steel fabrication company and also in a software development company.