What’s Good for Multinationals Isn’t Good for Manufacturing or the Country

The years 1940 to 1980 were good times for American manufacturing. During this period, the U.S. experienced tremendous economic growth that built the middle class and launched the notion of the America Dream, where every generation expected to exceed their parents. But after 1980, the American economy began to change.

The economic changes began after the economist Milton Friedman said, “an entity’s greatest responsibility lies in the satisfaction of the shareholders.” The Business Roundtable translated his comment into shareholder value, or the idea that the point of a business enterprise is to generate economic returns to its owners, period.

For the last 40 years, multinational corporations’ (MNCs) pursuit of low labor costs and short-term profits became the driving force that led to American manufacturing slowly moving offshore. During this period, the financial sector took over the economy and manufacturing declined, and there was enormous financial pressure on the MNCs to invest in projects with the best short-term returns, while investments in plants and equipment became a lower priority.

In 2001, the U.S. allowed China into the WTO and the MNCs began building plants in China to sell to the growing Chinese middle class as well as export back to the U.S. The government made an agreement with China, but China ignored the agreement and exploited the U.S. using mercantilism, and our government chose not to enforce our trade agreements. As investment in plants in China and Asia grew, MNCs accelerated outsourcing of jobs and production, and our trade deficit began to grow. Since 1998, according to the Economic Policy Institute, America has lost 5 million manufacturing jobs and 80,000 manufacturing businesses.

After 1980, the new model for American manufacturers was to do the R&D, design and marketing, and outsource the manufacturing of the product to low-cost countries. Economists, academics and the MNCs enthusiastically embraced the free-trade model because they believed that "it was more beneficial to let market forces move you in the direction of your comparative advantage.” This model became a China-centric model creating jobs in China and deindustrializing the U.S. The result was that MNCs fueled the industrialization of China at the expense of U.S. manufacturing. The MNCs have created an economy that pits shareholder value and short-term profit against wage earners, communities, and manufacturing.

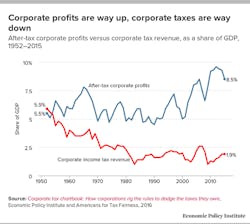

The media always touts the low unemployment of 3.5% in 2019 and the record stock market growth as indictors of a booming economy. But when you examine the longer-term picture, it is a different story. America went from 4.6% GDP growth in 1970 to 1.91% GDP growth in 2009. Trade deficits grew from $130 billion in 1980 to $681 billion in 2020. According to the Bureau of Labor Statistics, manufacturing has lost 7.5 million jobs since 1980. The following chart shows that as corporate profits increased, corporate tax revenue decreased, adding to the federal deficit.

During this period, currency manipulation was used by our trading partners to gain a price advantage, making their exports cheaper and our exports more expensive. Our government was complicit in the problem because both Democrats and Republicans supported the multinational short-term profit and outsourcing agenda, and ignored both currency manipulation and the dollar value. President Biden said recently he would, “take aggressive trade enforcement actions against China or any other country seeking to undercut American manufacturing through unfair trade practices, including currency manipulation, anti-competitive dumping, state-owned company abuses or unfair subsidies.”

Biden had a chance to take aggressive action on currency manipulation when the Trump administration declared Taiwan, Vietnam, Switzerland and China currency manipulators. But his Treasury Secretary Janet Yellen removed three countries from the list of manipulators, and it appears that the new administration will do nothing about currency manipulation or the value of the dollar. Like all previous administrations, it looks like the government will favor the financial objectives of the MNCs, which totally contradicts what Biden has publicly said about manufacturing and creating jobs.

The Role of Wall Street

Wall Street loves a strong dollar and accepts currency manipulation primarily because an overvalued dollar keeps import prices low and fuels the profits of the big importers like Apple, Amazon, Costco and Walmart. To finance the trade deficit, Wall Street bond traders also make money brokering the sales of stocks and bonds purchased by our competitors to keep the dollar value high. In his article, “The Rise of Wall Street and the Fall of American Investment, Oren Cass makes the case that Wall Street bleeds investment from industry to fund speculation and short-term profits.

Two hundred fifty-four Chinese companies who are part of China's "Made in China 25" plan are working to dominate emerging industries like artificial intelligence, clean energy, semiconductors, biotechnology, cloud computing, etc. They are all part of a new stock exchange called the Science and Technology Innovation Board (STAR Market), which accumulates capital to fund the growth of these companies and make China’s Made in China 2025 plan a success.

China doesn't have to list their companies on the U.S. stock exchange anymore to acquire venture capital—Wall Street is coming to them and investing in the new Star market. The Coalition for a Prosperous America said recently, "The U.S. is funding China's rise and in increasing numbers. It's a free market and capital is the freest of all, and will seek out where it is easiest to make returns.” This begs the question: How can we compete against China if Wall Street is allowed to invest in its growth?

Advanced Technology

To manufacture in China, the MNCs had to sign technology transfer agreements that eventually gave our competitors our technologies. There are 50 advanced technology industries that are vital to the American economy because they are our best shot at maintaining competitive advantage against foreign competitors. However, America has been running trade deficits in advanced technologies since 2002, and we are losing these technologies almost as fast as they are invented because the MNCs want to manufacture them in low-labor-cost countries.

The irony is that outsourcing to foreign countries is not a good long-term strategy, because eventually the foreign supplier will master the technology and dominate the market, as has happened in the semiconductor industry. When the corporations lose control of the manufacturing and the market, they will come back to the U.S. government to be bailed out like Intel and the chip industry are currently doing.

The McKinsey Global Institute has been a consultant to the MNCs for decades. The Coalition for a Prosperous American, in an April 2021 commentary, describes McKinsey as historically touting “open and free markets, big corporate power, and moving supply chains to scale up in Asia where labor was abundant and regulations were not.” But now McKinsey has changed its tune to say that the U.S. is facing “a now-or-never moment to regain capabilities and market share. There is also a growing sense that its frayed social fabric will not be repaired without more middle-class jobs and attention to the places that have been left behind.”

I think that McKinsey has reached a watershed moment where they see what is going to happen to our economy unless we make some real changes. Perhaps the semiconductor industry (which now needs a $50 billion bailout) has provided a lesson for what is going to happen to other declining U.S. industries and their MNCs.

The interests of U.S. multinationals and the interests of the country have diverged. The transition to the new service economy has been very hard on American manufacturing, citizens, communities and the country. A large part of the responsibility for what has happened can be attributed to America’s multinational corporations.

In August 2019, 181 CEOs signed a commitment letter to lead their companies not just for the benefit of their investors, but “for the benefit of all stakeholders: customers, employees, suppliers, communities, and shareholders.” Jamie Dimon, CEO of the Wall Street firm J.P. Morgan Chase, commented that, "the American dream is alive, but fraying. Major employers are investing in their workers and communities because they know it is the only way to be successful over the long term. These modernized principles reflect the business communities’ unwavering commitment to continue to push for an economy that serves all Americans.”

The only way, in my opinion, they can reach their new goals to help employees, communities, suppliers and the country is to back away from their “shareholder only” model and begin reshoring production, but so far, they are not walking their talk. Perhaps the MNCs might be listening to what McKinsey is saying or maybe they are following the government bailout of the semiconductor industry and wondering if it might happen to them.

MNCs and Wall Street now have the nation by the throat and are dictating the future of manufacturing and of living standards. What is good for them has turned out not to be good for employees, American manufacturing, communities or the country. We are at a “now-or-never moment.

Michael Collins is the author of The Rise of Inequality and the Decline of the Middle Class and can be reached at mpcmgt.net.