China Manufacturing Outlook: Stabilization Followed by Modest Growth

A slowdown in China’s economic expansion saw a deceleration to 7.6% growth in the second quarter of 2012 from 8.1% in the first quarter. Manufacturing production moderated considerably, but modest advancement should return in 2013, according to a new report.

The growth pace of industrial value-added decelerated to 9.5% by June 2012 compared with the 14% growth rate in 2011, according to the Manufacturers Alliance for Productivity and Innovation (MAPI) report, “China Manufacturing Outlook 2012-2013 (EO-112).” The analysis explains the sales revenue forecast for China’s manufacturing in general, and provides a detailed analysis and forecasts for 2012 and 2013 for a selected group of 13 of its most important industries.

“Investment growth, the major driver for manufacturing production, slowed from an average of 27% during 2007-2011 to 20% in the first two quarters as stimulus support for public investment in infrastructure was withdrawn and credit-dependent private investment in residential property was impacted by authorities’ prudent control over monetary policy,” explains economist Yingying Xu, Ph.D, author of the report. “In addition, weaker external demand has been a key factor in China’s manufacturing outlook. Export value increased only 11% by June, compared with more than 20% growth in 2011.

“We expect China’s growth momentum to pick up in the second half of 2012, underpinned by the acceleration in infrastructure investment spending and social housing construction,” Xu added.

China’s economy grew 9.2% in 2011 and MAPI’s forecasts are for 7.8% growth in 2012 and 8.0% growth in 2013. These figures are down from previous estimates of 8.4% growth in 2012 and 8.6% growth in 2013.

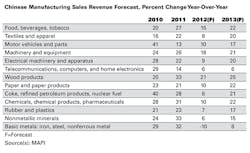

MAPI predicts that final 2012 manufacturing sales revenue growth will be 8%, compared with the previous forecast of 16% in January 2012. In 2013, growth is forecast to accelerate to 17%, compared with the previous forecast of 19%.

Wood products are expected to show the most growth in 2012 and 2013, at 21% and 25%, respectively. Machinery and equipment sales revenue is anticipated to grow by 18% in 2012 and 21% in 2013, and food, beverages, and tobacco by 15% and 22%, respectively.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek