Manufacturing Business Confidence Plummets in April

Manufacturing pessimism has spiked dramatically in April as industrial producers deal with changing tariff plans and try to assess how global trade policy will impact their costs and operations in the coming months.

Several surveys released this week show huge swings in business confidence between January, when most manufacturers had a positive outlook for near-term conditions and the full year, and April, when sentiment changed for the much, much worse.

In the Federal Reserve Bank of Philadelphia’s monthly “Manufacturing Business Outlook Survey,” in January about 39% of businesses reported plans to increase capital spending this year to improve operations — a figure similar to high points reached in 2017 and during the COVID recovery in 2021. In April, that figure fell to 2%. For context, that metric went negative during inflation run-ups during 2023 and during the financial crisis in 2009 but only fell to 9.7% at the worst of the COVID declines.

In New York, the Fed’s “Empire State Manufacturing Survey” showed a similar decline, dropping to 1.6% of businesses with capital spending increases planned, down from 9.2% in March.

“Firms expect conditions to worsen in the months ahead, a level of pessimism that has only occurred a handful of times in the history of the survey,” the Empire State authors wrote in their report. “The index for future general business conditions fell twenty points to -7.4; the index has fallen a cumulative forty-four points over the past three months.”

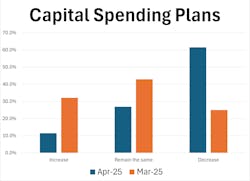

Some of the most dramatic declines came from the Equipment Leasing Finance Foundation (ELFF), an organization that represents lenders that help manufacturers obtain new capital equipment for factories. In March, more than half of manufacturers surveyed by that group expected capital spending to increase or stay about the same in the next four months. By April, more than 61% said they expect spending to fall.

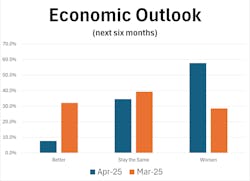

The ELFA survey also noted a massive rise in pessimism on the general health of the U.S. economy. When asked in March what they expected for the next six months, manufacturers were generally positive or neutral, with nearly one-third expecting conditions to improve and about one-quarter saying they expected things to worsen. Asked the same question in April, more than half (57.7%) said they expected conditions to worsen.

Survey data always reflects a moment in time, and most of the negative sentiment came from surveys conducted during the lead-up to President Donald Trump’s announcements of massive tariffs on virtually all U.S. trading partners, with massive duties on incoming European, South American and Asian goods. While 145% tariffs on some Chinese goods remain in place, Trump later paused the bulk of the new import taxes for 90 days. Whether or not that will impact sentiment is a question for the May surveys due out in about a month.

James D. Jenks, CEO of Global Finance and Leasing Services LLC, told ELFA, “The uncertainty of what tariffs will or will not be put in place, and when, is not helping the economy in the near term.”

However, other respondents were more optimistic.

Charles Jones, senior vice president of 1st Equipment Finance Inc. told ELFA survey takers, “Turbulent times...doom and gloom mixed with increased opportunities. Tariffs could lead to higher prices for parts and equipment. They also will result in ‘creative’ financing opportunities to help borrowers protect cash flow and offset higher prices for goods. Once you get past the fear, it’s an exciting time to be in equipment finance.”

And, some indicators from slightly earlier in the year show some signs of growth in manufacturing capital spending. The Association for Manufacturing Technology’s monthly U.S. Manufacturing Technology Orders report showed an 8.8% increase in capital equipment spending by U.S. manufacturers in January and February, matching optimistic forecasts from 2024.

Orders from electrical equipment producers were particularly strong. The growth of AI and data centers has created a massive demand for electrical grid improvements nationwide — transformers, switchgear and other equipment.

Investments in Electrical Grid Improvements

- Hitachi Energy invests $70M to expand high-voltage manufacturing facilities in Pennsylvania (Plant Services)

- Google’s AI-Powered Grid Revolution: How Data Centers Are Reshaping the U.S. Power Landscape (Data Center Frontier)

- DTE Electric Plan Approved to Expedite Innovation for Distributed Energy Resources, Grid Reliability (T&D World)

- America Needs More Electricity: Production Pulse

- Schneider Electric to Invest Over $700 Million in U.S. Operations Through 2027 to Support Energy, AI Sectors and Job Growth (T&D World)

About the Author

Robert Schoenberger

Editor-in-Chief

LinkedIn: linkedin.com/in/robert-schoenberger-4326b810

Bio: Robert Schoenberger has been writing about manufacturing technology in one form or another since the late 1990s. He began his career in newspapers in South Texas and has worked for The Clarion-Ledger in Jackson, Mississippi; The Courier-Journal in Louisville, Kentucky; and The Plain Dealer in Cleveland where he spent more than six years as the automotive reporter. In 2014, he launched Today's Motor Vehicles (now EV Manufacturing & Design), a magazine focusing on design and manufacturing topics within the automotive and commercial truck worlds. He joined IndustryWeek in late 2021.