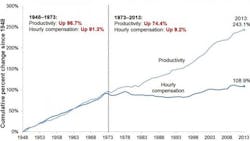

For the last 35 years, hourly wages have been falling far behind economy-wide productivity. This has led to wage stagnation and inequality, which is now being felt by the majority of middle-class workers.

Nowhere is this more obvious than in the manufacturing part of the economy. The following graph tells the story. The graph below shows that up until 1973 hourly compensation kept up with productivity. But in the late 1970s, corporations began to go all out to reduce their labor costs. The chart shows that productivity rose 243% from 1973 to 2013 and hourly compensation only grew by 9.2%.

Working people are not sure how this happened to them, but the culmination of these years has led to the angry supporters of Donald Trump and Bernie Sanders. Working families are now really feeling the pain of these trends, but they don’t understand the policy decisions and strategies that created this situation. This overview shows that corporation were incredibly successful at lowering labor costs by using the following strategies:

Automation: Automation of production lines began to eliminate jobs in the 1960s. I was part of this effort, because I managed two divisions that were part of the automation: palletizers and robots. After 1980, big corporations began investing more heavily in labor reducing equipment to eliminate blue collar jobs.

Then along came the internet and personal computers, which helped corporations eliminate millions of white collar jobs too.

Union membership: American corporations have made a concerted effort to get rid of unions since 1980, and they have been very successful. In 2013, the unionized workforce in America hit a 97 year low. Only 11.3% of all workers were unionized. In the private sector, unionization fell to 6.6%, down from a peak of 35% in the 1950s.

The Economic Policy Institute notes: "The decline of unions can explain about a third of the entire growth of wage inequality among men and around a fifth of the growth among women from 1973 to 2007."

Outsourcing & Offshoring: More than 5 million U.S. manufacturing jobs were lost between 1997 and 2014. Most of those job losses were due to growing trade deficits with countries that have negotiated trade and investment deals with the United States.

Between 2001, when China came into the WTO, and 2013, the U.S. trade deficit with China increased $240 billion. These growing trade deficits eliminated 3.2 million U.S. jobs. This fueled the growth of thousands of new manufacturing plants in China that generated exports to the United States and other markets.

Temporary and contract workers: Many of the jobs that have been created since the beginning of the Great Recession have been part-time or temporary jobs. The U.S. Bureau of Labor Statistics notes that part-time or temporary jobs grew from 1.9 million in Jan. 2010, to 2.7 million in July 2013. The survey also reports that 30% of these people would like to get full time jobs.

In addition to part time jobs, many other changes have impacted wages including: the lowering of the inflation-adjusted value of the federal minimum wage, the decrease in overtime eligibility for workers, and the misclassification of workers as independent contractors.

There are several reasons for the surge in part time jobs. First, businesses are still uncertain of the recovery and do not want to hire full time people and then lay them off if there is a downturn. Second, consumer demand (measured as consumption) is still too low and many manufacturing sectors have too much capacity. Third, it also appears that many small businesses are trying to keep their headcounts below 50 people to avoid Obamacare.

One problem is that part-time and temporary workers usually don’t get any benefits. But the real downside is that people with these kinds of jobs simply do not make enough money to support a family without using food stamps, and other government support.

In addition to part time and temporary workers, there is another growing category called contract workers. These are full-time workers who are self-employed but not part of any company’s head count. They do not receive benefits and have to pay their own payroll taxes.

Contract workers are a new and growing employment category in the new economy. The government estimates that 2.39% or about 3 million people in the workforce are contractors. Contractors are popular in manufacturing, janitorial services, food service, computer programming, home care services, healthcare and a host of other industries.

Contract workers might be the wave of the future as corporations continue to try to reduce their head counts. The online job site CareerBuilders.com, cites research that shows "42% of all employers intend to hire temporary or contract workers as part of their staffing strategy--a 14% increase over the last 5 years.”

All of these job categories are contributing to the trend in declining or stagnant wages of the middle class.

Financial Deregulation: The deregulation of the finance industry also has contributed to the lower wages because it shifted the income to the upper end of the income scale. Corporations also lobbied Congress to ignore the trade deficit and to eliminate any attempt at changing labor laws.

The Economic Policy Institute research found that, "Falling top tax rates, preferential tax treatment of stock options and bonuses, failures in corporate governance, and the deregulation of finance all combined to increase the incentive and the ability of well-placed economic actors to claim larger incomes over the past generation."

Two-Tier Wage Systems: The most insidious strategy to reduce wages was the introduction of the two-tier pay system, which was part of the move toward temporary and part–time jobs. Generally, the two–tier pay system rewards long-time employees, allowing them to keep thier current wages and benefits, but reduces wages and benefits of all new employees. This encourages older union workers to vote against younger workers to maintain their status and further erodes the union solidarity. Over time, as older workers retire and new workers are hired, the overall wage scale of the company declines.

A good example of this strategy is the auto industry. After Chrysler and GM filed for bankruptcy, the United Auto Workers accepted a two-tier wage pay system that kept senior workers at $29 per hour and new hires at $16 per hour, in addition to cuts in their benefits and healthcare. The auto industry projects that they will hire 14,750 people in the next few years at the new lower wage.

Since 1980, two-tier wage programs have been used in the airline, railroads, construction, chemicals, electrical machinery, petroleum, printing textiles, food, transportation equipment, communications, health services, finance, insurance, steel, aircraft production, tire, wholesale and retail industries.

Inequality: The irony of this story of decreasing wages and benefits of workers is the anomaly of CEO compensation. As wages and income declined, corporate profits rose--along with the salaries and benefits of CEOs. A research report from the Economic Policy Institute revealed that, “In 1965, U.S. CEOs in major companies earned 24 times more than an average worker; this ratio grew to 35 in 1978 and to 71 in 1989. The ratio surged in the 1990s and hit 300 at the end of the recovery in 2000." Since then, however, CEO pay has exploded and, by 2005, the average CEO was paid $10,982,000 a year, or 262 times that of an average worker ($41,861). Working people know of this inequality, and it sticks in their craw. Inequality is now part of the political rise of both Donald Trump and Bernie Sanders voters.

Free market capitalists make the case that the market dictates prices and wages based on competition, and supply and demand. But labor has not been in a position to have any leverage since globalization started. So wages have stagnated or fallen while corporate profits and CEO salaries have reached new heights. Wages have fallen from 50% of GDP to 43.5% since 2001, while wages of the top 1% have climbed from 7.3% to 12.9% of GDP. An economist at the University of California found that the top 1% of households garnered 65% of the nation’s income growth between 2002 and 2007.

The Biggest Problem – GDP growth

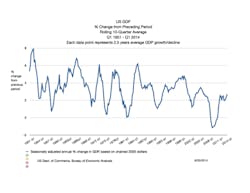

Since year 2000, Gross Domestic Product growth has been an anemic 1.8%, and consumer consumption is now 71% of the economy. The relentless effort by the corporations to reduce labor costs has been very successful, but now consumer consumption is not high enough to buy all the goods that America’s factories can produce.

The chart below is very revealing. If you draw a line connecting the highs or lows it shows that GDP growth is on a downward trend. Yes, we have rebounded since 2008, but the long-term trend is down.This is the most unusual recovery since the Great Depression. Manufacturing jobs have not rebounded, job growth in general is slow, the growth of the economy has averaged only 1.8% since year 2000, overall demand is low, and capital investment is low.

Perhaps the most important factor today is that consumption is down, and consumption is 71% of our economy. We are in a Catch-22 economy. Corporations are not going to increase capital investments because there is not enough demand. But there is not enough demand because wages are low.

So what can be done?

Corporations are not people. They are not patriotic, nationalistic, loyal, empathetic or benevolent. They are not going to raise wages unless they are forced to by the law of supply and demand. That is how free market capitalism works.

We must also consider that we are now in a service economy. According to the U.S. Bureau of Labor statistics, 94.69% of the jobs created between 2014 and 2024 will be in the service part of the economy. Their chart, Employment by major occupational group 2014 projected 2024, shows that 81.7% of the total projected jobs (130,989,000 jobs) will have median annual wages of less than $42,000 per year. Sixty-five percent will earn less than $37,000 per year. So we can’t rely on the service industry to improve wages and income.

The only obvious answer that emerges from all of this data is to make a national commitment to increase the manufacturing and construction sectors of the economy. We could do this for construction if Congress was willing to fund the $3 trillion required to upgrade all of the infrastructure.

However, manufacturing is a different issue, because it is largely controlled by foreign policy changes. First, we would have to make increasing manufacturing a national goal, which would take the political support of both parties. Then we would have to demand that the WTO force countries to stop manipulating their currencies and enforce existing protection of our technologies. This also requires offering tax incentives to multinational corporations to stop outsourcing jobs and begin bringing them back to the U.S.

As food, healthcare, daycare, and rent costs continue to increase, working Americans find it increasingly hard to make ends meet and instead live paycheck to paycheck. We already have seen a populist reaction to this threat in Trump and Sanders supporters, but I am afraid that it is a much bigger powder keg, waiting to explode. A plan to grow manufacturing and fund America’s infrastructure might not be the total answer, but it is a step in the right direction.

Michael Collins is the author of The Rise Of Inequality and the Decline Of The Middle Class. You can reach him at mpcmgt.com.