U.S. bilateral trade with China and Mexico, particularly the growing deficits the U.S. carries with the two nations, generally drives the conversation about U.S. manufacturing trade. With the latest report on U.S. international trade in goods and services, from the Commerce Department’s U.S. Census Bureau and the U.S. Bureau of Economic Analysis, Canada just might be moving into the spotlight.

The report covering October, released earlier last week, notes that the trade balance in goods with Canada “shifted from a surplus of $0.2 billion in September to a deficit of $1.7 billion in October.” Exports to the country decreased by $0.9 billion to $22.0 billion, while imports increased $1.0 billion to $23.6 billion for the month.

Still, by far the biggest deficit is with China. In October, the U.S. deficit with China increased $2.0 billion to $28.9 billion. That represented an increase in goods exports of $0.5 billion to $10.6 billion and an increase in imports of $2.4 billion to $39.5 billion.

The deficit with Mexico also increased in October by $1 billion to $5.8 billion.

In an analysis of the first six months of the year, published last fall, the Manufacturers Alliance for Productivity and Innovation (MAPI), focused on China and Mexico.

Comparing the U.S. and China, the report noted: “The extreme contrast in export competitiveness between the two dominant trading nations, in favor of China, is shocking. Chinese exports of $935 billion were 68% larger than the $555 billion of U.S. exports. This contrast is especially striking considering that in 2000, U.S. manufactured exports were three times larger than Chinese exports.”

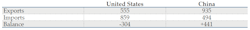

U.S. and Chinese Global Trade in Manufactures (January to June 2016, $billions)

For the first half of 2016, the U.S. deficit with China was $168 billion, or 55% of the global deficit, according to the MAPI report.

As for the U.S.’s growing deficit with Mexico, the MAPI analysis reports: “The growing and now excessive U.S. bilateral deficit with Mexico in manufactures developed only over the past couple of years and is the result of the successful North American Free Trade Agreement (NAFTA). Until recently, a modest deficit with Mexico was offset by a U.S. surplus in manufactures with Canada, within NAFTA. Now, however, and unlike other troubled and less developed Latin American economies, Mexico has risen to become a ‘newly industrialized’ economy, as did South Korea 12+ years ago.”

U.S. Bilateral Trade in Manufactures With China and Mexico (January to June 2016, $billions)

For the first half of 2016, the U.S. deficit with Mexico was $30 billion, or 10% of the global deficit.

Overall, U.S. goods exports, on a balance of payments basis, in October decreased $3.5 billion to $123.1 billion, while goods imports increased $2.8 billion to $186.5 billion. By industry category, consumer goods exports decreased, on a Census basis, by $0.9 billion, while imports increased by $2.4 billion, including an increase of imports of pharmaceutical preparations (+$2.7 billion) and cell phones (+0.4 billion).

Capital goods imports increased $1.1 billion, including an increase of imports of computer accessories (+$0.6 billion), while imports of automotive vehicles parts and engines decreased $0.7 billion.

October exports of capital goods on a Census basis, at $43.7 billion, were the highest since December 2015 ($44 billion).

October imports of goods on Census basis, at 184.8 billion, were the highest since September 2015 (185.6 billion).

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek