After a robust 60% surge from 2010 to 2015, growth in aerospace and defense (A&D) exports have slowed, according to Deloitte's “2017 US aerospace and defense sector export and labor market study.”

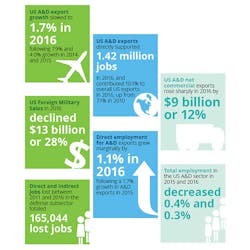

Although A&D comprised approximately 10% of total 2016 exports and grew $2.5 billion, the rapid growth seen over the past years decelerated from 4% in 2015 to 1.7% in 2016.

“The slower pace of growth is due to a decline in export financing, the strengthening of the U.S. dollar, and global competition,” said Robin Lineberger, principal, Deloitte Consulting LLP and global and U.S. aerospace and defense sector leader. “While American-manufactured A&D products remain attractive to foreign customers, U.S .exports are more costly in the international market. Global competitors increased proficiency in manufacturing A&D products; and competitive currencies and lower labor cost will continue to press US A&D export growth in the coming years.”

A&D sector exports remained a major contributor to overall U.S. exports, adding approximately $85 billion to the positive trade balance in 2016 and making A&D the top contributor to the U.S. trade balance among major sectors.

The A&D sector is one of the top employers to the economy, supporting 4.1 million direct and indirect jobs at approximately twice the national wage rate. While sector employment has fallen over the last five years, the rate of decline has tapered off, from 2.2% in 2014 to 0.3% in 2016.

“The Budget Control Act of 2011 likely affected the defense subsector and largely contributed to the decline in overall A&D sector employment over the past five years,” added Lineberger. “Productivity continues to grow as process automation and robotics increasingly replace traditional labor, and companies improve efficiencies through consolidation and M&A activity.”

Foreign Military Sales (FMS) significantly declined in 2016 by 28% or $13 billion breaking a three-year growth trend. However, 2017 may be a significant growth year for this sector, driven by helicopter, missile, and other military sales to the Asia Pacific and Middle East regions. While commercial aerospace exports have outpaced both direct commercial defense exports and FMS, on a combined basis, defense exports and FMS have represented a significant portion of overall A&D exports. Their contribution could exceed 40% of total exports in the next two years.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek