US Remains Competitive Despite Stronger Dollar, BCG Reports

Manufacturers in the United States have seen the dollar rise sharply against other currencies this past year but that has not changed U.S. firms’ overall competitiveness, according to new data from the Boston Consulting Group.

“While the major drop in the euro has reduced costs for European exporters, they’re still about 10% more expensive on average than U.S.-based manufacturers,” said Harold L. Sirkin, a BCG senior partner and a coauthor of the analysis. “The U.S. remains one of the lowest-cost locations for manufacturing in the developed world.”

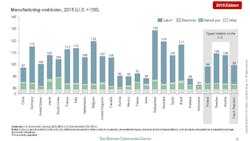

BCG updated its Global Manufacturing Cost-Competitiveness Index, introduced in mid-2014, which tracks production costs in the 25 largest export economies. While the stronger dollar helped close the competitiveness gap with countries such as Germany, France, Japan, Australia, and Brazil, the U.S. remains a cheaper place to manufacture goods.

Factors contributing to the continuing U.S. cost advantage:

Labor productivity: Improved labor productivity in the U.S. is largely offsetting wage increases, BCG noted.

Energy: The U.S. continues to enjoy lower energy costs driven by the huge increase in shale gas production. Natural gas is not only used increasingly in producing electricity but serves as a feedstock for chemicals and plastics. “The spot price of natural gas traded on the New York Mercantile Exchange has dropped by more than 40%, to about $2.75 per million British thermal units, over the past year,” BCG stated.

While a number of European countries saw their competitiveness ranking against the U.S. improve by 6% to 12% in the past year, BCG said direct manufacturing costs were still “around 10 to 20% higher in economies such as France, Germany, Italy, and Belgium.”

Other developed economies showed similar results, according to BCG’s research.

“The U.S. dollar gained around 13% against the yen, but Japan’s manufacturing cost structure remains 7 percentage points higher than that of the U.S. The dollar gained 14% against the Canadian dollar, but that nation’s cost-competitiveness improved by 6 points. The U.S. dollar rose 20% against the Brazilian real and 10% against the Australian dollar, but manufacturing costs in those countries remain 17% higher and 19% higher, respectively, than those in the U.S.”

While U.S. manufacturers should consider hedging options to cope with exchange-rate volatility and energy-price changes, the authors of the BCG study stated, they should stick with their long-term strategies for locating plants and geographically diversifying their supply chains.

“They should also reduce their exposure in low-cost economies where wages are rising quickly if those goods are being exported around the world,” they said. “Instead, companies should focus on increasing productivity and making greater use of automation, such as robotics.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.