China’s Threat to the US Vehicle Market Is Overblown

We’ve all heard the current political rumblings about Chinese vehicles coming to the United States. The threat of low-cost competition destroying the Detroit 3—and also, perhaps, Tesla and Rivian—is a popular election-season topic this year. So are concerns about customer data collected by the various on-board computing systems and used by foreign entities, including the Chinese government.

Our deeper look into prices, volumes, manufacturing locations and consequences, however, tells a more complex story.

Trade Limits with Unintended Consequences

Today’s protectionist rhetoric is reminiscent of the early 1980s, when Japan agreed to a voluntary export program limiting the number of vehicles that would be imported into the United States. The program was the result of political pressure and potential legislation attempting to protect domestic manufacturers. At the time, domestic manufacturers had 75% of the U.S. market.

Share Your Opinions on Manufacturing Technology

IndustryWeek is in the midst of our annual technology survey. We'd love to hear your thoughts on how well technology suppliers are supporting manufacturing and what's working (and not working) with your tech investments. People who complete the survey will enter a drawing for one of two $50 Amazon gift cards. Please take some time and share your thoughts.

Japanese brands now have 6.3 million units of capacity in North America, or 68% of Detroit 3’s total capacity. Overall, 77% of sales in North America remain sourced from USMCA production.

The local production of Asian brands enabled additional luxury competition from Lexus, Acura and Genesis. This second wave of Asian competition diminished the earning potential of Cadillac, Lincoln and Chrysler.

The Third Asian Wave Is Already Here

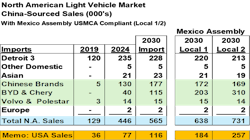

Chinese-made vehicles have been sold in Mexico for over five years under the brands MG, Chevrolet and Omoda. Chinese imports are expected to sell 446,000 units in North America this year, or 2.3% of light vehicle sales. Eighty-one percent will be sold in Mexico.

Additionally, Volvo and Polestar are premium brands owned by Chinese companies with local manufacturing presence in South Carolina. A good presumption is that these vehicles contain the same computer chips that are used in Chinese imports.

Meanwhile, the Detroit 3 automakers also reap the benefits of the current trade climate with China and Mexico. U.S. vehicles are exported to China and Mexico. General Motors is the largest importer of Chinese-sourced vehicles in Mexico. Buick has sold its China-made Envision in the United States for over five years, and Lincoln started importing its China-made Nautilus this year. Volvo will follow by the end of the year when it brings its EX30 all-electric vehicle to the U.S.

Mexico Assembly

Competition will ultimately determine the level of Chinese sales in the United States, assuming fair trade. Recent press announcements from BYD, a Chinese vehicle powerhouse, have indicated the company is exploring an assembly plant in Mexico to ostensibly serve the Mexican market (most likely it would also serve a broader North America market).

This announcement caused a political uproar, with candidate Donald Trump indicating it would be a “bloodbath” for American vehicle manufacturers. Other members of Congress have piled on by expressing fear of low-cost Chinese imports.

There are many groups weighing in on the dangers of Chinese vehicles being sold in the United States. Most opinions lack data or forward-looking volume estimates, unfortunately.

This volume and assumption framework is an important part of the debate. To wit, we are providing three potential Chinese assembly scenarios in Mexico. The baseline analysis starts with an estimate of demand under existing trade rules. U.S. import duties on Chinese vehicle imports are 27.5% due to President Trump invoking Section 232 of the Trade Expansion Act of 1962. This limits demand in the United States for Chinese imports. However, vehicles sourced from complete-knock-down (CKD) assembly in Mexico would only have a 2.5% duty.

BYD adds 75,000 units of CKD Capacity in Mexico in 2027

Looking out to 2030, Chinese imports into North America would grow to 565,000 units based on our forecasts. BYD would enter the U.S. in 2027 with a 16-state distribution strategy and sell approximately 40,000 units sourced from CKD assembly in Mexico. The conquest volume from the Detroit 3 would be minimal. This initial production strategy would come on top of BYD’s existing bus plant in Lancaster, California.

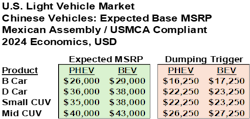

2030: BYD with 150,000 units of Capacity in Mexico (Local 1):

- BYD with USMCA-compliant assembly (U.S. imports are duty free).

- 4 models: 2 cars and 2 CUVs as BEV only (MSRP below).

- 48-state distribution.

- U.S duties on vehicle imports from China at 27.5%. (HS 8703)

- Mexico duties on vehicle imports from China at 15% (HS 8703)

- No revisions in USMCA rules through 2030.

The prices of BYD vehicles imported from Mexico would be competitive with sales leaders in the U.S. market. Thus, these imports would not be subject to countervailing duties to counteract dumping.

Dumping thresholds have also been estimated. Chinese prices would have to be below these amounts for the dumping complaint to be considered. For example, there are imported passenger cars that sell in the U.S. for less than $23,000. Likewise, there are small CUVs that sell for less than $24,000. Given Ford’s announced plans for battery-electric vehicles under $30,000, the dumping triggers appear to be reasonable estimates.

2030: BYD & Chery with 150,000 units of Capacity in Mexico (Local 2):

- BYD with USMCA-compliant assembly by 2030 (U.S. imports are duty-free)

- 4 models: 2 cars and 2 CUVs as BEV only.

- 48 state distribution

- Chery with USMCA-compliant assembly by 2030 (U.S. imports are duty free)

- 3 models: 1 car and 2 CUVs with BEV and PHEV.

- 48 state distribution.

- Same duty and USMCA assumptions as the Local 1 scenario.

Sales of Chinese vehicles in the United States under the Local 2 scenario would be 257,000, or 1.5% of the light vehicle market. This would hardly amount to a bloodbath. Chinese-sourced volume in North America would be much higher at 731,000 with most of the sales in Mexico or exported outside the USMCA region.

The 141,000 units of incremental volume generated by seven new BYD and Chery models would conquest 35,000 units of Detroit 3 volume. However, more damage will be inflicted on the Detroit 3 by the 32 additional models launched by existing and new competitors over the same time frame. The lack of passenger models in their portfolio doesn’t help either.

In essence, the third wave of Asian models is only a piece of the changing competitive landscape.

Potential Unintended Consequences

Import duties and trade restrictions are intended to protect domestic production and labor at the expense of consumers. Sometimes the duties are warranted, like when products are being dumped (sold below cost) into a market. Yet, these duties are imposed after the violation is discovered, not before.

It is conceivable that the U.S. could impose 27.5% duties on Chinese imports from Mexico that are USMCA-compliant. However, this would violate USMCA rules as approved by Congress. This policy variant could be implemented under that same rationale that President Trump used early in his administration—but it would be a real stretch.

The requirement to differentiate Chinese models from General Motors and Ford exports would be threading a needle. Potential retaliation would likely come from the Chinese government.

The U.S. could elect to exit USMCA in 2026 and begin to apply significant import duties on all Mexican exports—Detroit 3 and others. Perhaps that is candidate Trump’s intent.

This new policy could help U.S. labor, but the higher product cost would increase prices and dampen demand. This would result in a negative cost increase for the Detroit 3, Nissan, Toyota, Volkswagen and any other manufacturer using Mexico as a manufacturing base to supply U.S. consumption. What would Tesla do with their new Mexican facility?

National Security

Then comes the larger national security argument about Chinese spying through connected vehicles. If it is a chip argument, then all Chinese vehicles in the U.S. would have to be restricted, and this may include chips that the Chinese provide to other manufacturers. The restrictions would include Volvo, Polestar, BYD, Chery and Buick and Lincoln imports.

Be careful what you ask for. If the U.S. needs an enhanced industrial policy that would protect GM, Ford and Stellantis, then it needs to be comprehensive, and transparent to trading partners. It needs to comprehend a rewrite and congressional approval of the USMCA agreement, more local content requirements and joint-venture requirements for investment in the United States.

A ban on Chinese brands due to national security reasons would need to be long-lasting and specific. Automotive suppliers should listen to the rhetoric. More importantly, they should continue to press U.S. trade representatives and political candidates to support any claims with a rational look at the data and assumptions.

Given the size of U.S. auto investment in China, the debate needs to happen at the negotiating table, not on the campaign trail.

Warren Browne is an adjunct professor of economics and trade at Lawrence Technological University.

Sam Fiorani is vice president, global forecasting, AutoForecast Solutions LLC.

About the Author

Warren Browne

President, RFQ Insights

Warren Browne, president of RFQ Insights, has held senior executive positions at General Motors Corp, working in six countries over a 40-year career with the automaker. He is currently an adjunct professor of trade and economics at Lawrence Technological University.